Page 43 - AAE PR REPORT - August 2024

P. 43

8/12/24, 10:43 AM Al Ansari Financial Services’ Financial Results for the First Half of 2024 | Web Release

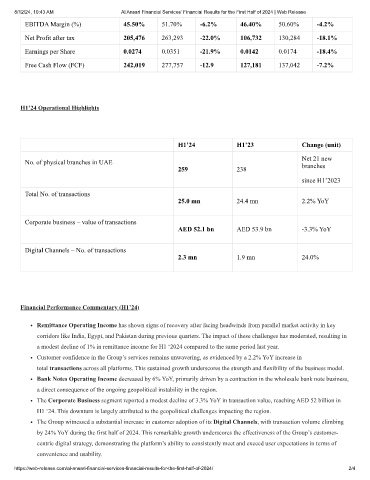

EBITDA Margin (%) 45.50% 51.70% -6.2% 46.40% 50.60% -4.2%

Net Profit after tax 205,476 263,293 -22.0% 106,732 130,284 -18.1%

Earnings per Share 0.0274 0.0351 -21.9% 0.0142 0.0174 -18.4%

Free Cash Flow (FCF) 242,019 277,757 -12.9 127,181 137,042 -7.2%

H1’24 Operational Highlights

H1’24 H1’23 Change (unit)

Net 21 new

No. of physical branches in UAE branches

259 238

since H1’2023

Total No. of transactions

25.0 mn 24.4 mn 2.2% YoY

Corporate business – value of transactions

AED 52.1 bn AED 53.9 bn -3.3% YoY

Digital Channels – No. of transactions

2.3 mn 1.9 mn 24.0%

Financial Performance Commentary (H1’24)

Remittance Operating Income has shown signs of recovery after facing headwinds from parallel market activity in key

corridors like India, Egypt, and Pakistan during previous quarters. The impact of these challenges has moderated, resulting in

a modest decline of 1% in remittance income for H1 ‘2024 compared to the same period last year.

Customer confidence in the Group’s services remains unwavering, as evidenced by a 2.2% YoY increase in

total transactions across all platforms. This sustained growth underscores the strength and flexibility of the business model.

Bank Notes Operating Income decreased by 6% YoY, primarily driven by a contraction in the wholesale bank note business,

a direct consequence of the ongoing geopolitical instability in the region.

The Corporate Business segment reported a modest decline of 3.3% YoY in transaction value, reaching AED 52 billion in

H1 ‘24. This downturn is largely attributed to the geopolitical challenges impacting the region.

The Group witnessed a substantial increase in customer adoption of its Digital Channels, with transaction volume climbing

by 24% YoY during the first half of 2024. This remarkable growth underscores the effectiveness of the Group’s customer-

centric digital strategy, demonstrating the platform’s ability to consistently meet and exceed user expectations in terms of

convenience and usability.

https://web-release.com/al-ansari-financial-services-financial-results-for-the-first-half-of-2024/ 2/4