Page 249 - SALIK PR REPORT ENGLISH AUGUST 2024

P. 249

-

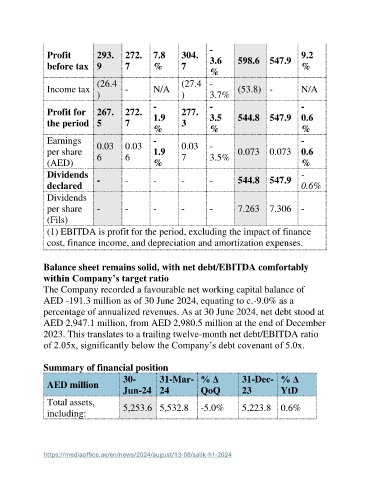

Profit 293. 272. 7.8 304. 3.6 598.6 547.9 9.2

before tax 9 7 % 7 %

%

(26.4 (27.4 -

Income tax - N/A (53.8) - N/A

) ) 3.7%

- - -

Profit for 267. 272. 1.9 277. 3.5 544.8 547.9 0.6

the period 5 7 3

% % %

Earnings 0.03 0.03 - 0.03 - -

per share 6 6 1.9 7 3.5% 0.073 0.073 0.6

(AED) % %

Dividends -

declared - - - - - 544.8 547.9 0.6%

Dividends

per share - - - - - 7.263 7.306 -

(Fils)

(1) EBITDA is profit for the period, excluding the impact of finance

cost, finance income, and depreciation and amortization expenses.

Balance sheet remains solid, with net debt/EBITDA comfortably

within Company’s target ratio

The Company recorded a favourable net working capital balance of

AED -191.3 million as of 30 June 2024, equating to c.-9.0% as a

percentage of annualized revenues. As at 30 June 2024, net debt stood at

AED 2,947.1 million, from AED 2,980.5 million at the end of December

2023. This translates to a trailing twelve-month net debt/EBITDA ratio

of 2.05x, significantly below the Company’s debt covenant of 5.0x.

Summary of financial position

30- 31-Mar- % Δ 31-Dec- % Δ

AED million

Jun-24 24 QoQ 23 YtD

Total assets, 5,253.6 5,532.8 -5.0% 5,223.8 0.6%

including:

https://mediaoffice.ae/en/news/2024/august/13-08/salik-h1-2024