Page 43 - AAE PR REPORT - AUGUST 2025

P. 43

8/14/25, 9:34 AM Al Ansari Financial Services’ H1 2025 operating income increases by 13% to a record AED 638mln

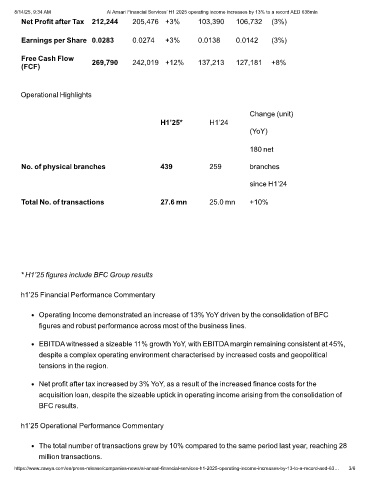

Net Profit after Tax 212,244 205,476 +3% 103,390 106,732 (3%)

Earnings per Share 0.0283 0.0274 +3% 0.0138 0.0142 (3%)

Free Cash Flow 269,790 242,019 +12% 137,213 127,181 +8%

(FCF)

Operational Highlights

Change (unit)

H1’25* H1’24

(YoY)

180 net

No. of physical branches 439 259 branches

since H1’24

Total No. of transactions 27.6 mn 25.0 mn +10%

* H1’25 figures include BFC Group results

h1’25 Financial Performance Commentary

Operating Income demonstrated an increase of 13% YoY driven by the consolidation of BFC

figures and robust performance across most of the business lines.

EBITDA witnessed a sizeable 11% growth YoY, with EBITDA margin remaining consistent at 45%,

despite a complex operating environment characterised by increased costs and geopolitical

tensions in the region.

Net profit after tax increased by 3% YoY, as a result of the increased finance costs for the

acquisition loan, despite the sizeable uptick in operating income arising from the consolidation of

BFC results.

h1’25 Operational Performance Commentary

The total number of transactions grew by 10% compared to the same period last year, reaching 28

million transactions.

https://www.zawya.com/en/press-release/companies-news/al-ansari-financial-services-h1-2025-operating-income-increases-by-13-to-a-record-aed-63… 3/6