Page 66 - SALIK PR REPORT MAY 2024

P. 66

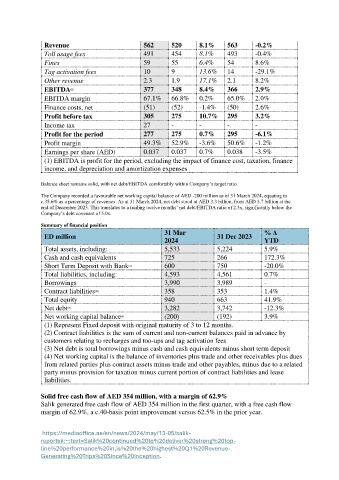

Revenue 562 520 8.1% 563 -0.2%

Toll usage fees 491 454 8.1% 493 -0.4%

Fines 59 55 6.4% 54 8.6%

Tag activation fees 10 9 13.6% 14 -29.1%

Other revenue 2.3 1.9 17.1% 2.1 8.2%

EBITDA 377 348 8.4% 366 2.9%

(1)

EBITDA margin 67.1% 66.8% 0.2% 65.0% 2.0%

Finance costs, net (51) (52) -1.4% (50) 2.6%

Profit before tax 305 275 10.7% 295 3.2%

Income tax 27 - - - -

Profit for the period 277 275 0.7% 295 -6.1%

Profit margin 49.3% 52.9% -3.6% 50.6% -1.2%

Earnings per share (AED) 0.037 0.037 0.7% 0.038 -3.5%

(1) EBITDA is profit for the period, excluding the impact of finance cost, taxation, finance

income, and depreciation and amortization expenses

Balance sheet remains solid, with net debt/EBITDA comfortably within Company’s target ratio

The Company recorded a favourable net working capital balance of AED -200 million as of 31 March 2024, equating to

c.35.6% as a percentage of revenues. As at 31 March 2024, net debt stood at AED 3.3 billion, from AED 3.7 billion at the

end of December 2023. This translates to a trailing twelve months’ net debt/EBITDA ratio of 2.3x, significantly below the

Company’s debt covenant of 5.0x.

Summary of financial position

31 Mar % Δ

ED million 31 Dec 2023

2024 YTD

Total assets, including: 5,533 5,224 5.9%

Cash and cash equivalents 725 266 172.3%

Short Term Deposit with Bank 600 750 -20.0%

(1)

Total liabilities, including: 4,593 4,561 0.7%

Borrowings 3,990 3,989 -

Contract liabilities 358 353 1.4%

(2))

Total equity 940 663 41.9%

Net debt 3,282 3,742 -12.3%

(3)

Net working capital balance (200) (192) 3.9%

(4)

(1) Represent Fixed deposit with original maturity of 3 to 12 months.

(2) Contract liabilities is the sum of current and non-current balances paid in advance by

customers relating to recharges and too-ups and tag activation fees

(3) Net debt is total borrowings minus cash and cash equivalents minus short term deposit

(4) Net working capital is the balance of inventories plus trade and other receivables plus dues

from related parties plus contract assets minus trade and other payables, minus due to a related

party minus provision for taxation minus current portion of contract liabilities and lease

liabilities.

Solid free cash flow of AED 354 million, with a margin of 62.9%

Salik generated free cash flow of AED 354 million in the first quarter, with a free cash flow

margin of 62.9%, a c.40-basis point improvement versus 62.5% in the prior year.

https://mediaoffice.ae/en/news/2024/may/13-05/salik-

reports#:~:text=Salik%20continued%20to%20deliver%20strong%20top-

line%20performance%20in,is%20the%20highest%20Q1%20Revenue-

Generating%20Trips%20Since%20Inception.