Page 179 - SALIK PR REPORT - MARCH 2024

P. 179

3/5/24, 2:13 PM PRESSR: Salik reports record full-year revenues of AED 2.1bln — TradingView News

for the period, excluding the impact of finance cost, finance income, and depreciation and amortization expenses

23 totalled AED 1,098 million, including an AED 550 million dividend equivalent to [7.3338] Fils per share, proposed

of 2023, to be distributed to shareholders subject to approval at the AGM

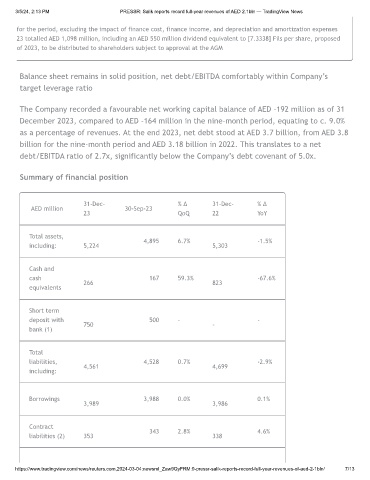

Balance sheet remains in solid position, net debt/EBITDA comfortably within Company’s

target leverage ratio

The Company recorded a favourable net working capital balance of AED -192 million as of 31

December 2023, compared to AED -164 million in the nine-month period, equating to c. 9.0%

as a percentage of revenues. At the end 2023, net debt stood at AED 3.7 billion, from AED 3.8

billion for the nine-month period and AED 3.18 billion in 2022. This translates to a net

debt/EBITDA ratio of 2.7x, significantly below the Company’s debt covenant of 5.0x.

Summary of financial position

31-Dec- % Δ 31-Dec- % Δ

AED million 30-Sep-23

23 QoQ 22 YoY

Total assets, 4,895 6.7% -1.5%

including: 5,224 5,303

Cash and

cash 167 59.3% -67.6%

266 823

equivalents

Short term

deposit with 500 - -

750 -

bank (1)

Total

liabilities, 4,528 0.7% -2.9%

4,561 4,699

including:

Borrowings 3,988 0.0% 0.1%

3,989 3,986

Contract 343 2.8% 4.6%

liabilities (2) 353 338

https://www.tradingview.com/news/reuters.com,2024-03-04:newsml_Zaw9QyFRM:0-pressr-salik-reports-record-full-year-revenues-of-aed-2-1bln/ 7/13