Page 2 - Demo

P. 2

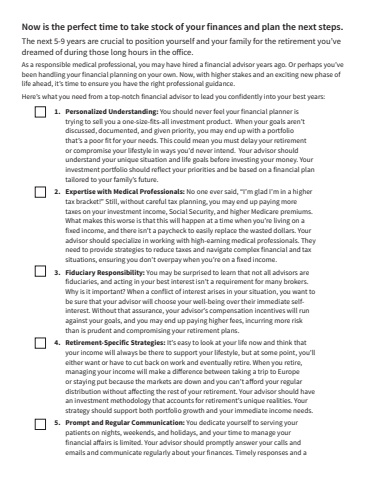

Now is the perfect time to take stock of your finances and plan the next steps.The next 5-9 years are crucial to position yourself and your family for the retirement you%u2019ve dreamed of during those long hours in the office.As a responsible medical professional, you may have hired a financial advisor years ago. Or perhaps you%u2019ve been handling your financial planning on your own. Now, with higher stakes and an exciting new phase of life ahead, it%u2019s time to ensure you have the right professional guidance.Here%u2019s what you need from a top-notch financial advisor to lead you confidently into your best years:1. Personalized Understanding: You should never feel your financial planner is trying to sell you a one-size-fits-all investment product. When your goals aren%u2019t discussed, documented, and given priority, you may end up with a portfolio that%u2019s a poor fit for your needs. This could mean you must delay your retirement or compromise your lifestyle in ways you%u2019d never intend. Your advisor should understand your unique situation and life goals before investing your money. Your investment portfolio should reflect your priorities and be based on a financial plan tailored to your family%u2019s future.2. Expertise with Medical Professionals: No one ever said, %u201cI%u2019m glad I%u2019m in a higher tax bracket!%u201d Still, without careful tax planning, you may end up paying more taxes on your investment income, Social Security, and higher Medicare premiums. What makes this worse is that this will happen at a time when you%u2019re living on a fixed income, and there isn%u2019t a paycheck to easily replace the wasted dollars. Your advisor should specialize in working with high-earning medical professionals. They need to provide strategies to reduce taxes and navigate complex financial and tax situations, ensuring you don%u2019t overpay when you%u2019re on a fixed income.3. Fiduciary Responsibility: You may be surprised to learn that not all advisors are fiduciaries, and acting in your best interest isn%u2019t a requirement for many brokers. Why is it important? When a conflict of interest arises in your situation, you want to be sure that your advisor will choose your well-being over their immediate selfinterest. Without that assurance, your advisor%u2019s compensation incentives will run against your goals, and you may end up paying higher fees, incurring more risk than is prudent and compromising your retirement plans.4. Retirement-Specific Strategies: It%u2019s easy to look at your life now and think that your income will always be there to support your lifestyle, but at some point, you%u2019ll either want or have to cut back on work and eventually retire. When you retire, managing your income will make a difference between taking a trip to Europe or staying put because the markets are down and you can%u2019t afford your regular distribution without affecting the rest of your retirement. Your advisor should have an investment methodology that accounts for retirement%u2019s unique realities. Your strategy should support both portfolio growth and your immediate income needs.5. Prompt and Regular Communication: You dedicate yourself to serving your patients on nights, weekends, and holidays, and your time to manage your financial affairs is limited. Your advisor should promptly answer your calls and emails and communicate regularly about your finances. Timely responses and a