Page 113 - The Millionaire Mindset

P. 113

Credit Life Insurance

If you go to a bank to apply for a loan, the manager often says, “’Tick the box’

and we’ll insure the loan in case anything happens to you; the loan will be paid off.” The

problem is, it’s grossly overpriced. Many of these small rip-offs span decades and can add

up to thousands even tens of thousands, of dollars.

Mortgage Life Insurance

This insurance pays off your mortgage if you die. What makes this a rip-off is that

you pay the same high premium for the duration, but the mortgage amount declines. Let’s

say you have a $100,000 mortgage and you insure the mortgage. If you die in 20 years and

you only owe $15,000 on your mortgage, the insurance company will pay the mortgage

company (not you) $15,000. You have been paying a $100,000 premium for 20 years. A

better strategy is to buy a “term life” policy for the amount of the mortgage. If you die in

20 years still owing $15,000 on the mortgage, your estate gets $100,000.

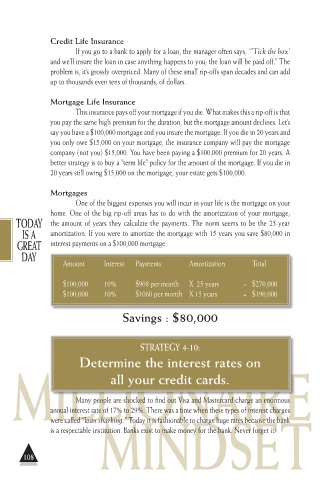

Today Mortgages

is a One of the biggest expenses you will incur in your life is the mortgage on your

great home. One of the big rip-off areas has to do with the amortization of your mortgage;

day the amount of years they calculate the payments. The norm seems to be the 25-year

amortization. If you were to amortize the mortgage with 15 years you save $80,000 in

interest payments on a $100,000 mortgage.

Amount Interest Payments Amortization Total

$100,000 10% $908 per month X 25 years = $270,000

$100,000 10% $1060 per month X 15 years = $190,000

Savings : $80,000

Strategy 4-10:

Determine the interest rates on

all your credit cards.

Many people are shocked to find out Visa and Mastercard charge an enormous

annual interest rate of 17% to 29%. There was a time when these types of interest charges

Millionairewere called “loan sharking.” Today it is fashionable to charge huge rates because the bank

is a respectable institution. Banks exist to make money for the bank. Never forget it!

Mindset108