Page 30 - Accountantمحاسب

P. 30

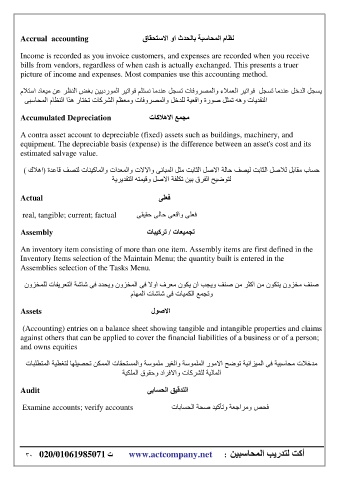

Accrual accounting قبمؾزعلاا ٚا سذؾٌبث خجعبؾٌّا َبظٔ

Income is recorded as you invoice customers, and expenses are recorded when you receive

bills from vendors, regardless of when cash is actually exchanged. This presents a truer

picture of income and expenses. Most companies use this accounting method.

َلازعا دبؼيِ ٓػ شظٌٕا غغث ٓييدسٌّٛا شيراٛف ٍُزغٔ بِذٕػ ًغغر دبفٚشظٌّاٚ ءلاّؼٌا شيراٛف ًغغر بِذٕػ ًخذٌا ًغغي

ٝجعبؾٌّا َبظٌٕا از٘ سبزخر دبوششٌا ُظؼِٚ دبفٚشظٌّاٚ ًخذٌٍ خيؼلاٚ حسٛط ًضّر ٗ٘ٚ دبيذمٌٕ ا

Accumulated Depreciation دبولا٘لاا غّغِ

A contra asset account to depreciable (fixed) assets such as buildings, machinery, and

equipment. The depreciable basis (expense) is the difference between an asset's cost and its

estimated salvage value.

) نلا٘ا( حذػبل فظزٌ دبٕيوبٌّاٚ داذؼٌّاٚ دلالااٚ ٝٔبجٌّا ًضِ ذثبضٌا ًطلاا خٌبؽ فظيٌ ذثبضٌا ًطلاٌ ًثبمِ ةبغؽ

خيشيذمزٌا ٗزّيلٚ ًطلاا خفٍىر ٓيث قشفٌا ؼيػٛزٌ

Actual ٍٝؼف

real, tangible; current; factual ٝميمؽ ٌٝبؽ ٝؼلاٚ ٍٝؼف

Assembly دبج١وشر / دبؼ١ّغر

An inventory item consisting of more than one item. Assembly items are first defined in the

Inventory Items selection of the Maintain Menu; the quantity built is entered in the

Assemblies selection of the Tasks Menu.

ْٚضخّ ٌٍ دبفيشؼزٌا خشبش ٝف دذؾيٚ ْٚضخٌّا ٝف لاٚا فشؼِ ْٛىي ْا تغيٚ فٕط ِٓ شضوا ِٓ ْٛىزي ْٚضخِ فٕط

َبٌّٙا دبشبش ٝف دبيّىٌا غّغرٚ

Assets يٛطلاا

(Accounting) entries on a balance sheet showing tangible and intangible properties and claims

against others that can be applied to cover the financial liabilities of a business or of a person;

and owns equities

دبجٍطزٌّا خيطغزٌ بٍٙيظؾر ٓىٌّّا دبمؾزغٌّاٚ خعٍِّٛ شيغٌاٚ خعٌٍّّٛا سِٛلاا ؼػٛر خئاضيٌّا ٝف خيجعبؾِ دلاخذِ

خي ىٌٍّا قٛمؽٚ داشفلااٚ دبوششٌٍ خيٌبٌّا

Audit ٝثبغؾٌا ك١لذزٌا

Examine accounts; verify accounts دبثبغؾٌا خؾط ذيوأرٚ خؼعاشِٚ ضؾف

31 020/01061985071 د www.actcompany.net : ٓ١جعبؾٌّا ت٠سذزٌ ذوأ