Page 119 - Caribbean-Central America Profile 2018

P. 119

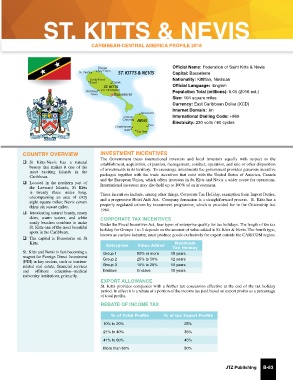

ST. KITTS & NEVIS

CARIBBEAN-CENTRAL AMERICA PROFILE 2018

Official Name: Federation of Saint Kitts & Nevis

ST. KITTS & NEVIS Capital: Basseterre

Nationality: Kittitian, Nevisian

ST. KITTS Official Language: English

Population Total (millions): 0.05 (2016 est.)

Size: 104 square miles

Currency: East Caribbean Dollar (XCD)

Internet Domain: .kn

International Dialling Code: +869

NEVIS

Electricity: 230 volts / 60 cycles

COUNTRY OVERVIEW INVESTMENT INCENTIVES

The Government treats international investors and local investors equally with respect to the

q St Kitts-Nevis has a natural establishment, acquisition, expansion, management, conduct, operation, and sale or other disposition

beauty that makes it one of the of investments in its territory. To encourage investments the government provides generous incentive

most exciting islands in the

Caribbean. packages together with the trade incentives that exist with the United States of America, Canada

q Located in the northern part of and the European Union, which offers investors in St. Kitts and Nevis a wider scope for operations.

International investors may also hold up to 100% of an investment.

the Leeward Islands, St Kitts

is twenty three miles long, These incentives include, among other things, Corporate Tax Holiday, exemption from Import Duties,

encompassing an area of sixty and a progressive Hotel Aids Act. Company formation is a straightforward process. St. Kitts has a

eight square miles; Nevis covers

thirty six square miles. properly regulated citizen by investment programme, which is provided for in the Citizenship Act

q Intoxicating natural beauty, sunny 1984.

skies, warm waters, and white CORPORATE TAX INCENTIVES

sandy beaches combine to make Under the Fiscal Incentives Act, four types of enterprise qualify for tax holidays. The length of the tax

St. Kitts one of the most beautiful holiday for Groups 1 to 3 depends on the amount of value added in St. Kitts & Nevis. The fourth type,

spots in the Caribbean. known as enclave industry, must produce goods exclusively for export outside the CARICOM region.

q The capital is Basseterre on St

Kitts. Maximum

Enterprise Value Added Tax Holiday

St. Kitts and Nevis is fast-becoming a Group I 50% or more 15 years

magnet for Foreign Direct Investment

(FDI) in key sectors, such as tourism- Group 2 25% to 50% 12 years

related real estate, financial services Group 3 10% to 25% 10 years

and offshore education--medical Enclave Enclave 15 years

university institutions, primarily.

EXPORT ALLOWANCE

St. Kitts provides companies with a further tax concession effective at the end of the tax holiday

period. In effect it is a rebate of a portion of the income tax paid based on export profits as a percentage

of total profits.

REBATE OF INCOME TAX

% of Total Profits % of tax Export Profits

10% to 20% 25%

21% to 40% 35%

41% to 60% 45%

More than 60% 50%

JTZ Publishing B-83