Page 54 - P&C Handbook

P. 54

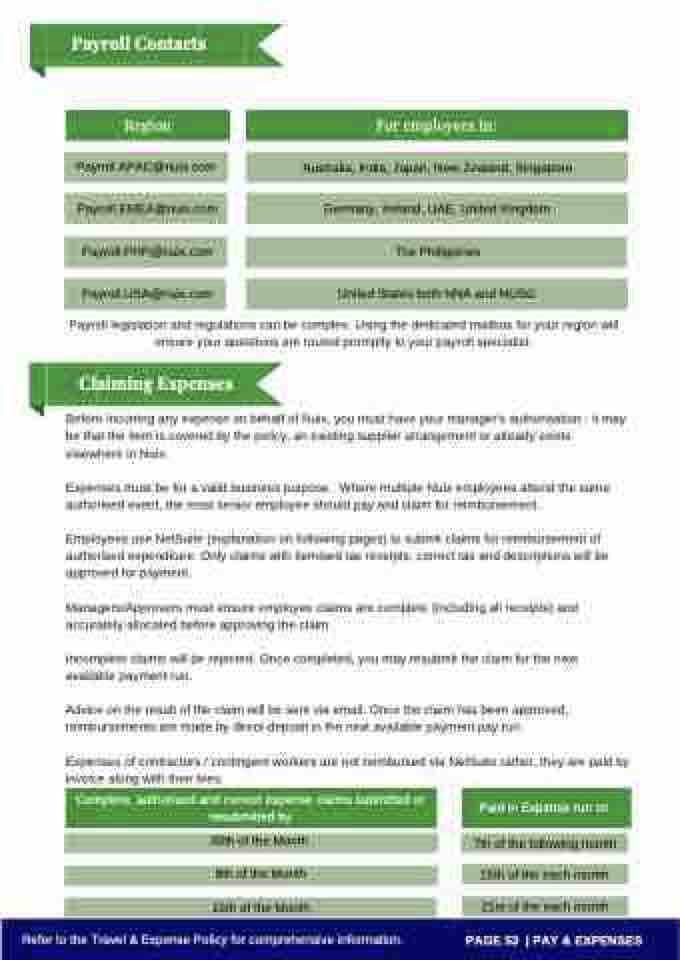

Payroll Contacts

Region

Payroll.APAC@nuix.com

Payroll.EMEA@nuix.com

Payroll.PHP@nuix.com

Payroll.USA@nuix.com

For employees in:

Australia, India, Japan, New Zealand, Singapore Germany, Ireland, UAE, United Kingdom

The Philippines

United States both NNA and NUSG

Payroll legislation and regulations can be complex. Using the dedicated mailbox for your region will ensure your questions are routed promptly to your payroll specialist.

Claiming Expenses

Before incurring any expense on behalf of Nuix, you must have your manager's authorisation - it may be that the item is covered by the policy, an existing supplier arrangement or already exists elsewhere in Nuix.

Expenses must be for a valid business purpose. Where multiple Nuix employees attend the same authorised event, the most senior employee should pay and claim for reimbursement.

Employees use NetSuite (explanation on following pages) to submit claims for reimbursement of authorised expenditure. Only claims with itemised tax receipts, correct tax and descriptions will be approved for payment.

Managers/Approvers must ensure employee claims are complete (including all receipts) and accurately allocated before approving the claim.

Incomplete claims will be rejected. Once completed, you may resubmit the claim for the next available payment run.

Advice on the result of the claim will be sent via email. Once the claim has been approved, reimbursements are made by direct-deposit in the next available payment pay run.

Expenses of contractors / contingent workers are not reimbursed via NetSuite rather, they are paid by invoice along with their fees.

Complete, authorised and correct expense claims submitted or resubmitted by

30th of the Month

Paid in Expense run on

7th of the following month

8th of the Month 15th of the each month

21st of the each month

15th of the Month

Refer to the Travel & Expense Policy for comprehensive information. PAGE 53 | PAY & EXPENSES