Page 128 - Practice Set Akuntansi Perusahaan Dagang - Kelas XI SMK/MAK

P. 128

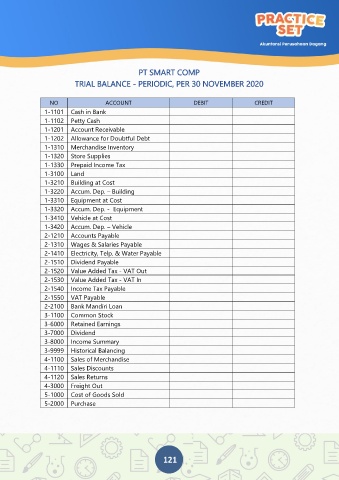

PT SMART COMP

TRIAL BALANCE - PERIODIC, PER 30 NOVEMBER 2020

NO ACCOUNT DEBIT CREDIT

1-1101 Cash in Bank

1-1102 Petty Cash

1-1201 Account Receivable

1-1202 Allowance for Doubtful Debt

1-1310 Merchandise Inventory

1-1320 Store Supplies

1-1330 Prepaid Income Tax

1-3100 Land

1-3210 Building at Cost

1-3220 Accum. Dep. – Building

1-3310 Equipment at Cost

1-3320 Accum. Dep. - Equipment

1-3410 Vehicle at Cost

1-3420 Accum. Dep. – Vehicle

2-1210 Accounts Payable

2-1310 Wages & Salaries Payable

2-1410 Electricity, Telp. & Water Payable

2-1510 Dividend Payable

2-1520 Value Added Tax - VAT Out

2-1530 Value Added Tax - VAT In

2-1540 Income Tax Payable

2-1550 VAT Payable

2-2100 Bank Mandiri Loan

3-1100 Common Stock

3-6000 Retained Earnings

3-7000 Dividend

3-8000 Income Summary

3-9999 Historical Balancing

4-1100 Sales of Merchandise

4-1110 Sales Discounts

4-1120 Sales Returns

4-3000 Freight Out

5-1000 Cost of Goods Sold

5-2000 Purchase

121