Page 129 - W01TB8_2017-18_[low-res]_F2F_Neat

P. 129

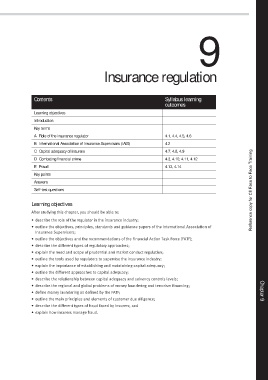

9

Insurance regulation

Contents Syllabus learning

outcomes

Learning objectives

Introduction

Key terms

A Role of the insurance regulator 4.1, 4.4, 4.5, 4.6

B International Association of Insurance Supervisors (IAIS) 4.2

C Capital adequacy of insurers 4.7, 4.8, 4.9

D Combating financial crime 4.3, 4.10, 4.11, 4.12

E Fraud 4.13, 4.14

Key points

Answers

Self-test questions Reference copy for CII Face to Face Training

Learning objectives

After studying this chapter, you should be able to:

• describe the role of the regulator in the insurance industry;

• outline the objectives, principles, standards and guidance papers of the International Association of

Insurance Supervisors;

• outline the objectives and the recommendations of the Financial Action Task Force (FATF);

• describe the different types of regulatory approaches;

• explain the need and scope of prudential and market conduct regulation;

• outline the tools used by regulators to supervise the insurance industry;

• explain the importance of establishing and maintaining capital adequacy;

• outline the different approaches to capital adequacy;

• describe the relationship between capital adequacy and solvency controls levels;

• describe the regional and global problems of money laundering and terrorism financing; Chapter

• define money laundering as defined by the FATF;

• outline the main principles and elements of customer due diligence; 9

• describe the different types of fraud faced by insurers; and

• explain how insurers manage fraud.