Page 136 - W01TB8_2017-18_[low-res]_F2F_Neat

P. 136

9/8 W01/March 2017 Award in General Insurance

Deterministic scenarios typically involve the use of stress and scenario testing reflecting an event, or a

change in conditions, with a set probability to model the effect of certain events (such as a drop in

equity prices) on the insurer’s capital position, in which the underlying assumptions would be fixed.

In contrast, stochastic modelling often involves simulating very large numbers of scenarios in order to

reflect the likely distributions of the capital required by, and the different risk exposures of, the insurer.

Where the internal model is used for regulatory capital purposes, the insurer would be expected to

There are numerous

methodologies which demonstrate why it has chosen a particular risk measure, and should include in its internal model an

an insurer could use appropriate reconciliation, if necessary, between the criteria used in the model for its own risk and

capital management and those set by the regulator.

Consider this…

What are the dangers if capital adequacy requirements for insurance companies are incorrect?

C3 Capital adequacy and solvency control levels

A regulator’s goal in establishing solvency control levels is to safeguard policyholders from loss due to

an insurer’s inability to meet its obligations.

The solvency control levels provide triggers for action by the insurer and regulator so are set at a level

that allows intervention at a sufficiently early stage in an insurer’s difficulties for the situation to be

rectified.

A solvency regime would also be expected to impose a market-wide nominal floor* to the regulatory

capital requirements, based on governance and the need for an insurer to operate with a certain minimal

critical mass. The nominal floor might vary between lines of business or type of insurer and is

particularly relevant in the context of a new insurer or line of business.

*In this context, a market-wide nominal floor may, for example, be an absolute dollar minimum amount of capital required to be held by

an insurer in a jurisdiction.

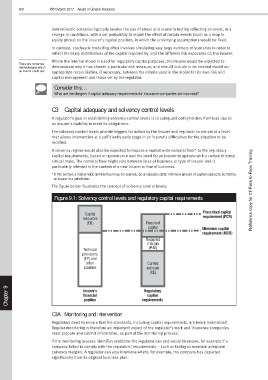

The figure below illustrates the concept of solvency control levels: Reference copy for CII Face to Face Training

Figure 9.1: Solvency control levels and regulatory capital requirements

Capital Prescribed capital

resources requirement (PCR)

(CR) Required

capital Minimum capital

requirement (MCR)

Required

margin

(RM)

Technical

provisions

(TP) and

other Current

liabilities estimate

(CE)

9 Insurer’s Regulatory

Chapter financial requirements

capital

position

C3A Monitoring and intervention

Regulators need to ensure that the standards, including capital requirements, are being maintained.

Regular monitoring is therefore an important aspect of the regulator’s work and insurance companies

must prepare and submit information, as part of the monitoring process.

If the monitoring process identifies problems the regulator can and would intervene, for example if a

company failed to comply with the regulators’ requirements – such as failing to maintain adequate

solvency margins. A regulator can also intervene where, for example, the company has departed

significantly from its original business plan.