Page 28 - W01TB8_2017-18_[low-res]_F2F_Neat

P. 28

1/10 W01/March 2017 Award in General Insurance

1

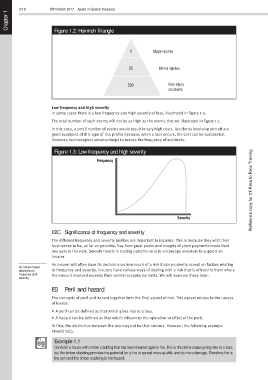

Chapter Figure 1.2: Heinrich Triangle

1 Major injuries

30 Minor injuries

300 Non-injury

accidents

Low frequency and high severity

In some cases there is a low frequency and high severity of loss, illustrated in figure 1.3.

The total number of such events will not be as high as the events that we illustrated in figure 1.1.

In this case, a small number of events would result in very high costs. Accidents involving aircraft are

good examples of this type of risk profile because, when a loss occurs, the cost can be substantial.

However, technological advance helps to reduce the frequency of accidents.

Figure 1.3: Low frequency and high severity

Frequency

Severity Reference copy for CII Face to Face Training

E2C Significance of frequency and severity

The different frequency and severity profiles are important to insurers. This is because they wish their

businesses to be, as far as possible, free from great peaks and troughs of claim payments made from

one year to the next. Smooth trends in trading patterns tend to encourage investors to support an

insurer.

An insurer will often base its decisions on how much of a risk it can prudently accept on factors relating

An insurer bases

decisions on to frequency and severity. Insurers have various ways of dealing with a risk that is offered to them where

frequency and the amount involved exceeds their normal acceptance limits. We will examine these later.

severity

E3 Peril and hazard

The concepts of peril and hazard together form the final aspect of risk. This aspect relates to the causes

of losses:

• A peril can be defined as that which gives rise to a loss.

• A hazard can be defined as that which influences the operation or effect of the peril.

At first, the distinction between the two may not be that obvious. However, the following example

should help.

Example 1.1

Consider a house with timber cladding that has been insured against fire. Fire is the prime cause giving rise to a loss,

but the timber cladding provides the potential for a fire to spread more quickly and do more damage, Therefore fire is

the peril and the timber cladding is the hazard.