Page 97 - W01TB8_2017-18_[low-res]_F2F_Neat

P. 97

Chapter 6 Proximate cause 6/3

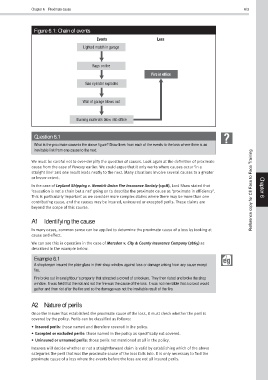

Figure 6.1: Chain of events

Events Loss

Lighted match in garage

Rags on fire

Fire in office

Gas cylinder explodes

Wall of garage blows out

Burning materials blow into office

Question 6.1

What is the proximate cause in the above figure? Draw lines from each of the events to the loss where there is an

inevitable link from one cause to the next.

We must be careful not to over-simplify the question of causes. Look again at the definition of proximate

cause from the case of Pawsey earlier. We could argue that it only works where causes occur ‘in a

straight line’ and one result leads neatly to the next. Many situations involve several causes to a greater

or lesser extent.

In the case of Leyland Shipping v. Norwich Union Fire Insurance Society (1918), Lord Shaw stated that Chapter

‘causation is not a chain but a net’ going on to describe the proximate cause as ‘proximate in efficiency’. Reference copy for CII Face to Face Training

This is particularly important as we consider more complex claims where there may be more than one 6

contributing cause, and the causes may be insured, uninsured or excepted perils. These claims are

beyond the scope of this course.

A1 Identifying the cause

In many cases, common sense can be applied to determine the proximate cause of a loss by looking at

cause and effect.

We can see this in operation in the case of Marsden v. City & County Insurance Company (1865) as

described in the example below.

Example 6.1

A shopkeeper insured the plate glass in their shop window against loss or damage arising from any cause except

fire.

Fire broke out in a neighbour’s property that attracted a crowd of onlookers. They then rioted and broke the shop

window. It was held that the riot and not the fire was the cause of the loss. It was not inevitable that a crowd would

gather and then riot after the fire and so the damage was not the inevitable result of the fire.

A2 Nature of perils

Once the insurer has established the proximate cause of the loss, it must check whether the peril is

covered by the policy. Perils can be classified as follows:

• Insured perils: those named and therefore covered in the policy.

• Excepted or excluded perils: those named in the policy as specifically not covered.

• Uninsured or unnamed perils: those perils not mentioned at all in the policy.

Insurers will decide whether or not a straightforward claim is valid by establishing which of the above

categories the peril that was the proximate cause of the loss falls into. It is only necessary to find the

proximate cause of a loss where the events before the loss are not all insured perils.