Page 187 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 187

Chapter 7 Contract wordings 7/25

D Clauses used in non-proportional wordings

D1 Basis of cover clause

This clause sets out the basis of the cover provided by the reinsurance contract. It describes the

Describes the

necessary relationship between the period of the reinsurance contract and a characteristic of the original necessary

insurance policy or claim, as appropriate. relationship

As you will see, on a losses occurring during (LOD) basis something must have happened during the

reinsurance contract period; for example, a loss/claim must occur or be made or discovered during that

period. On a risks attaching during (RAD) basis, the inception date of the original policy need only fall

within that period. Each basis is discussed in detail below.

Together, the period clause and the basis clause are known as the ‘commencement clause’.

RAD (or policies issued) basis

On this basis, reinsurers agree to assume liability for claims on risks or original policies attaching during Refer to chapter 5,

section B1 for

the period of the reinsurance. A risk or policy is considered to attach if: RAD basis

• it incepts;

• is re-signed (that is, multi-year contracts); or

• is treated as having been re-signed at the date when such risks, or part of such risks, have reached

any maximum period on any preceding period of reinsurance, during the period of the reinsurance.

Provided the inception date of a policy falls within the period of the reinsurance contract in question, the

reinsurers on that treaty will be liable for all claims arising from that policy.

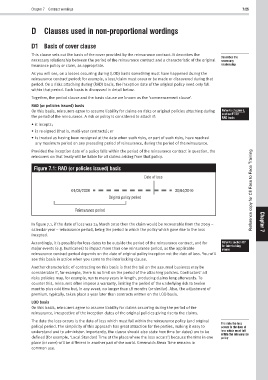

Figure 7.1: RAD (or policies issued) basis

Date of loss

01/05/2009 30/04/2010 Reference copy for CII Face to Face Training

Original policy period

Reinsurance period

In figure 7.1, if the date of loss was 24 March 2010 then the claim would be recoverable from the 2009 – Chapter

calendar year – reinsurance period, being the period in which the policy which gave rise to the loss 7

incepted.

Accordingly, it is possible for loss dates to be outside the period of the reinsurance contract, and for Refer to section D7

for interlocking

major events (e.g. hurricanes) to impact more than one reinsurance period, as the applicable clause

reinsurance contract period depends on the date of original policy inception not the date of loss. You will

see this basis in action when you come to the interlocking clause.

Another characteristic of contracting on this basis is that the tail on the assumed business may be

considerable if, for example, there is no limit on the period of the attaching policies. Contractors’ all

risks policies may, for example, run to many years in length, producing claims long afterwards. To

counter this, reinsurers often impose a warranty, limiting the period of the underlying risk to twelve

months plus odd time but, in any event, no longer than 18 months (or similar). Also, the adjustment of

premium, typically, takes place a year later than contracts written on the LOD basis.

LOD basis

On this basis, reinsurers agree to assume liability for claims occurring during the period of the

reinsurance, irrespective of the inception dates of the original policies giving rise to the claims.

The date the loss occurs is the date of loss which must fall within the reinsurance policy (and original

The date the loss

policy) period. The simplicity of this approach has great attraction for the parties, making it easy to occurs is the date of

understand and to administer. Importantly, the clause should also state how time (or dates) are to be loss which must fall

within the reinsurance

defined (for example, ‘Local Standard Time at the place where the loss occurs’) because the time in one policy

place (or zone) will be different in another part of the world. Greenwich Mean Time remains in

common use.