Page 270 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 270

10/2 M97/February 2018 Reinsurance

Introduction

In this chapter we shall look at how different types of reinsurance contracts and their functions apply to

property insurance. This process includes the way in which the various types of arrangements operate,

the choices open to cedants and the reasons for choosing a particular option. We also need to bear in

mind the underwriting implications from the reinsurer’s perspective.

As a starting point, we shall consider what is meant by ‘property insurance’ and some of the problems

which primary insurers face in writing this class of business.

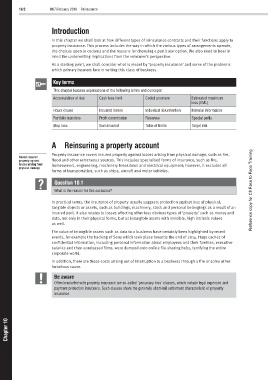

Key terms

This chapter features explanations of the following terms and concepts:

Accumulation of risk Cash loss limit Ceded premium Estimated maximum

loss (EML)

Hours clause Incurred losses Individual risk retention Material information

Portfolio transfers Profit commission Reserves Special perils

Stop loss Sum insured Table of limits Target risk

A Reinsuring a property account

Property insurance covers insured property against losses arising from physical damage, such as fire,

Covers insured

property against flood and other extraneous sources. This includes specialised forms of insurance, such as fire,

losses arising from homeowners, engineering, machinery breakdown and electrical equipment; however, it excludes all

physical damage

forms of transportation, such as ships, aircraft and motor vehicles.

Question 10.1

What is the reason for this exclusion? Reference copy for CII Face to Face Training

In practical terms, the insurance of property usually suggests protection against loss of physical,

tangible objects or assets, such as buildings, machinery, stock and personal belongings as a result of an

insured peril. It also relates to losses affecting other less obvious types of ‘property’ such as money and

data, not only in their physical forms, but as intangible assets with invisible, high intrinsic values

as well.

The value of intangible assets such as data to a business have certainly been highlighted by recent

events, for example the hacking of Sony which took place towards the end of 2014. Huge caches of

confidential information, including personal information about employees and their families, executive

salaries and then unreleased films, were dumped onto online file-sharing hubs, terrifying the entire

corporate world.

In addition, there are those costs arising out of interruption to a business through a fire or some other

fortuitous cause.

Be aware

Often bracketed with property insurance are so-called ‘pecuniary loss’ classes, which include legal expenses and

payment protection insurance. Such classes share the generally short-tail settlement characteristic of property

insurance.

10

Chapter