Page 35 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 35

Chapter 1 Purpose of and the parties involved in reinsurance 1/17 Chapter

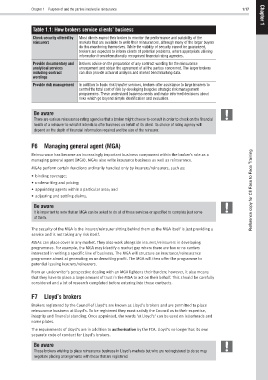

Table 1.1: How brokers service clients’ business 1

Check security offered by Most clients expect their broker to monitor the performance and suitability of the

reinsurers markets that are available to write their reinsurances, although many of the larger buyers

do this monitoring themselves. While the viability of security cannot be guaranteed,

brokers are expected to inform clients of potential problems, where appropriate utilising

information from internationally recognised financial rating agencies.

Provide documentary and Brokers advise on the preparation of any contract wording for the reinsurance

analytical services arrangement and obtain the agreement of all the parties concerned. The larger brokers

including contract can also provide actuarial analysis and market benchmarking data.

wordings

Provide risk management In addition to basic risk transfer services, brokers offer assistance to large insurers to

control the total cost of risk by developing bespoke strategic risk management

programmes. These understand business needs and make informed decisions about

risks which go beyond simple identification and evaluation.

Be aware

There are various reinsurance rating agencies that a broker might choose to consult in order to check on the financial

health of a reinsurer to which it intends to offer business on behalf of its client. Its choice of rating agency will

depend on the depth of financial information required and the size of the reinsurer.

F6 Managing general agent (MGA)

Reinsurance has become an increasingly important business component within the broker’s role as a

managing general agent (MGA). MGAs also write insurance business as well as reinsurance.

MGAs perform certain functions ordinarily handled only by insurers/reinsurers, such as:

• binding coverage;

• underwriting and pricing;

• appointing agents within a particular area; and Reference copy for CII Face to Face Training

• adjusting and settling claims.

Be aware

It is important to note that an MGA can be asked to do all of these services or specified to complete just some

of them.

The security of the MGA is the insurer/reinsurer sitting behind them as the MGA itself is just providing a

service and is not taking any risk itself.

MGAs can place cover in any market. They also work alongside insurers/reinsurers in developing

programmes. For example, the MGA may identify a market gap where there are few or no carriers

interested in writing a specific line of business. The MGA will structure an insurance/reinsurance

programme aimed at generating an underwriting profit. The MGA will then offer the programme to

potential issuing insurers/reinsurers.

From an underwriter’s perspective dealing with an MGA lightens their burden; however, it also means

that they have to place a large amount of trust in the MGA to act on their behalf. This should be carefully

considered and a lot of research completed before entering into these contracts.

F7 Lloyd’s brokers

Brokers registered by the Council of Lloyd’s are known as Lloyd’s brokers and are permitted to place

reinsurance business at Lloyd’s. To be registered they must satisfy the Council as to their expertise,

integrity and financial standing. Once appointed, the words ‘at Lloyd’s’ can be used on letterheads and

name plates.

The requirements of Lloyd’s are in addition to authorisation by the FCA. Lloyd’s no longer has its own

separate code of conduct for Lloyd’s brokers.

Be aware

Those brokers wishing to place reinsurance business in Lloyd’s markets but who are not registered to do so may

negotiate placing arrangements with those that are registered.