Page 7 - 2022 Benefit Guide Cinetic

P. 7

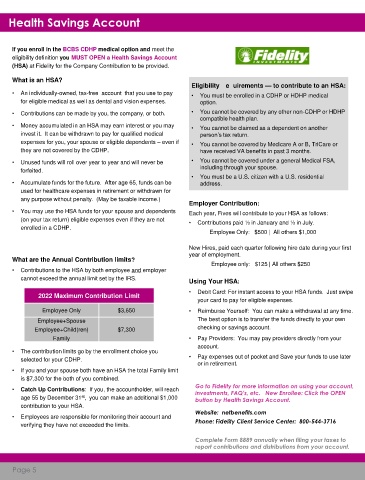

Health Savings Account

If you enroll in the BCBS CDHP medical option and meet the

eligibility definition you MUST OPEN a Health Savings Account

(HSA) at Fidelity for the Company Contribution to be provided.

What is an HSA?

Eligibility Requirements — to contribute to an HSA:

• An individually-owned, tax-free account that you use to pay • You must be enrolled in a CDHP or HDHP medical

for eligible medical as well as dental and vision expenses. option.

• Contributions can be made by you, the company, or both. • You cannot be covered by any other non-CDHP or HDHP

compatible health plan.

• Money accumulated in an HSA may earn interest or you may • You cannot be claimed as a dependent on another

invest it. It can be withdrawn to pay for qualified medical person’s tax return.

expenses for you, your spouse or eligible dependents – even if • You cannot be covered by Medicare A or B, TriCare or

they are not covered by the CDHP. have received VA benefits in past 3 months.

• Unused funds will roll over year to year and will never be • You cannot be covered under a general Medical FSA,

forfeited. including through your spouse.

• You must be a U.S. citizen with a U.S. residential

• Accumulate funds for the future. After age 65, funds can be address.

used for healthcare expenses in retirement or withdrawn for

any purpose without penalty. (May be taxable income.)

Employer Contribution:

• You may use the HSA funds for your spouse and dependents Each year, Fives will contribute to your HSA as follows:

(on your tax return) eligible expenses even if they are not • Contributions paid ½ in January and ½ in July.

enrolled in a CDHP.

Employee Only: $500 | All others $1,000

New Hires, paid each quarter following hire date during your first

year of employment.

What are the Annual Contribution limits?

Employee only: $125 | All others $250

• Contributions to the HSA by both employee and employer

cannot exceed the annual limit set by the IRS. Using Your HSA:

• Debit Card: For instant access to your HSA funds. Just swipe

2022 Maximum Contribution Limit

your card to pay for eligible expenses.

Employee Only $3,650 • Reimburse Yourself: You can make a withdrawal at any time.

Employee+Spouse The best option is to transfer the funds directly to your own

Employee+Child(ren) $7,300 checking or savings account.

Family • Pay Providers: You may pay providers directly from your

account.

• The contribution limits go by the enrollment choice you

selected for your CDHP. • Pay expenses out of pocket and Save your funds to use later

or in retirement.

• If you and your spouse both have an HSA the total Family limit

is $7,300 for the both of you combined.

Go to Fidelity for more information on using your account,

• Catch Up Contributions: If you, the accountholder, will reach investments, FAQ’s, etc. New Enrollee: Click the OPEN

age 55 by December 31 , you can make an additional $1,000 button by Health Savings Account.

st

contribution to your HSA.

Website: netbenefits.com

• Employees are responsible for monitoring their account and

verifying they have not exceeded the limits. Phone: Fidelity Client Service Center: 800-544-3716

Complete Form 8889 annually when filing your taxes to

report contributions and distributions from your account.

Page 5