Page 10 - Draken Intl. 2022 OE Flipbook

P. 10

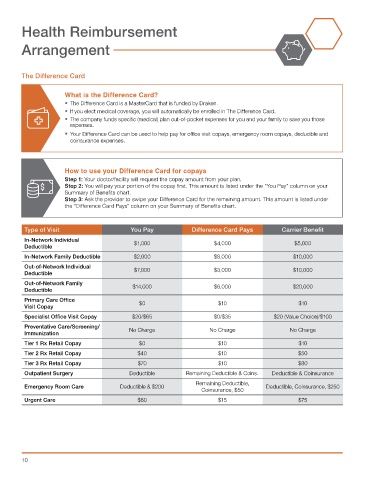

Health Reimbursement

Arrangement

The Difference Card

What is the Difference Card?

• The Difference Card is a MasterCard that is funded by Draken.

• If you elect medical coverage, you will automatically be enrolled in The Difference Card.

• The company funds specific (medical) plan out-of-pocket expenses for you and your family to save you those

expenses.

• Your Difference Card can be used to help pay for office visit copays, emergency room copays, deducible and

coinsurance expenses.

How to use your Difference Card for copays

Step 1: Your doctor/facility will request the copay amount from your plan.

Step 2: You will pay your portion of the copay first. This amount is listed under the “You Pay” column on your

Summary of Benefits chart.

Step 3: Ask the provider to swipe your Difference Card for the remaining amount. This amount is listed under

the “Difference Card Pays” column on your Summary of Benefits chart.

Type of Visit You Pay Difference Card Pays Carrier Benefit

In-Network Individual

Deductible $1,000 $4,000 $5,000

In-Network Family Deductible $2,000 $8,000 $10,000

Out-of-Network Individual

Deductible $7,000 $3,000 $10,000

Out-of-Network Family $14,000 $6,000 $20,000

Deductible

Primary Care Office

Visit Copay $0 $10 $10

Specialist Office Visit Copay $20/$65 $0/$35 $20 (Value Choice)/$100

Preventative Care/Screening/

Immunization No Charge No Charge No Charge

Tier 1 Rx Retail Copay $0 $10 $10

Tier 2 Rx Retail Copay $40 $10 $50

Tier 3 Rx Retail Copay $70 $10 $80

Outpatient Surgery Deductible Remaining Deductible & Coins. Deductible & Coinsurance

Remaining Deductible,

Emergency Room Care Deductible & $200 Deductible, Coinsurance, $250

Coinsurance, $50

Urgent Care $60 $15 $75

10