Page 11 - 2023 HCTec Benefits Guide Corporate

P. 11

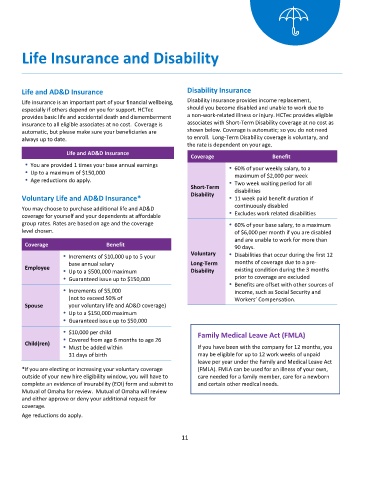

Life Insurance and Disability

Life and AD&D Insurance Disability Insurance

Life insurance is an important part of your financial wellbeing, Disability insurance provides income replacement,

especially if others depend on you for support. HCTec should you become disabled and unable to work due to

provides basic life and accidental death and dismemberment a non-work-related illness or injury. HCTec provides eligible

insurance to all eligible associates at no cost. Coverage is associates with Short-Term Disability coverage at no cost as

automatic, but please make sure your beneficiaries are shown below. Coverage is automatic; so you do not need

always up to date. to enroll. Long-Term Disability coverage is voluntary, and

the rate is dependent on your age.

Life and AD&D Insurance

Coverage Benefit

You are provided 1 times your base annual earnings

60% of your weekly salary, to a

Up to a maximum of $150,000

maximum of $2,000 per week

Age reductions do apply. Two week waiting period for all

Short-Term disabilities

Disability

Voluntary Life and AD&D Insurance* 11 week paid benefit duration if

continuously disabled

You may choose to purchase additional life and AD&D

Excludes work related disabilities

coverage for yourself and your dependents at affordable

group rates. Rates are based on age and the coverage 60% of your base salary, to a maximum

level chosen. of $6,000 per month if you are disabled

and are unable to work for more than

Coverage Benefit

90 days.

Voluntary Disabilities that occur during the first 12

Increments of $10,000 up to 5 your

base annual salary Long-Term months of coverage due to a pre-

Employee

Up to a $500,000 maximum Disability existing condition during the 3 months

Guaranteed issue up to $150,000 prior to coverage are excluded

Benefits are offset with other sources of

Increments of $5,000 income, such as Social Security and

(not to exceed 50% of Workers’ Compensation.

Spouse your voluntary life and AD&D coverage)

Up to a $150,000 maximum

Guaranteed issue up to $50,000

$10,000 per child Family Medical Leave Act (FMLA)

Child(ren) Covered from age 6 months to age 26

Must be added within If you have been with the company for 12 months, you

31 days of birth may be eligible for up to 12 work weeks of unpaid

leave per year under the Family and Medical Leave Act

*If you are electing or increasing your voluntary coverage (FMLA). FMLA can be used for an illness of your own,

outside of your new hire eligibility window, you will have to care needed for a family member, care for a newborn

complete an evidence of insurability (EOI) form and submit to and certain other medical needs.

Mutual of Omaha for review. Mutual of Omaha will review

and either approve or deny your additional request for

coverage.

Age reductions do apply.

11