Page 8 - Washington Nationals 2023 Benefits Guide -10.26.22_Neat

P. 8

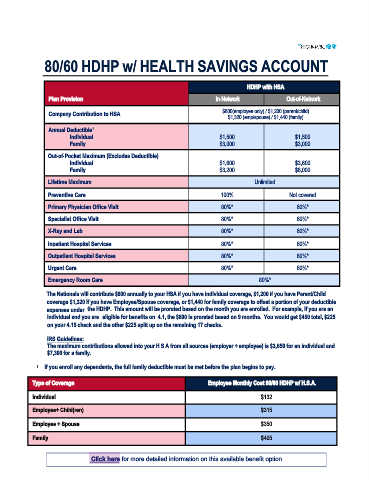

80/60 HDHP w/ HEALTH SAVINGS ACCOUNT

HDHP with HSA

Plan Provision In-Network Out-of-Network

$600(employee only) / $1,200 (parent/child)

Company Contribution to HSA

$1,320 (emp/spouse) / $1,440 (family)

Annual Deductible

1

Individual $1,500 $1,500

Family $3,000 $3,000

Out-of-Pocket Maximum (Excludes Deductible)

Individual $1,600 $3,600

Family $3,200 $6,000

Lifetime Maximum Unlimited

Preventive Care 100% Not covered

Primary Physician Office Visit 80%* 60%*

Specialist Office Visit 80%* 60%*

X-Ray and Lab 80%* 60%*

Inpatient Hospital Services 80%* 60%*

Outpatient Hospital Services 80%* 60%*

Urgent Care 80%* 60%*

Emergency Room Care 80%*

The Nationals will contribute $600 annually to your HSA if you have individual coverage, $1,200 if you have Parent/Child

coverage $1,320 if you have Employee/Spouse coverage, or $1,440 for family coverage to offset a portion of your deductible

expenses under the HDHP. This amount will be prorated based on the month you are enrolled. For example, if you are an

individual and you are eligible for benefits on 4.1, the $600 is prorated based on 9 months. You would get $450 total, $225

on your 4.15 check and the other $225 split up on the remaining 17 checks.

IRS Guidelines:

The maximum contributions allowed into your H S A from all sources (employer + employee) is $3,650 for an individual and

$7,300 for a family.

1 If you enroll any dependents, the full family deductible must be met before the plan begins to pay.

Type of Coverage Employee Monthly Cost 80/60 HDHP w/ H.S.A.

Individual $132

Employee+ Child(ren) $315

Employee + Spouse $350

Family $405

Click here for more detailed information on this available benefit option.