Page 125 - Touching All the Bases- Power point 2023 v2_Neat

P. 125

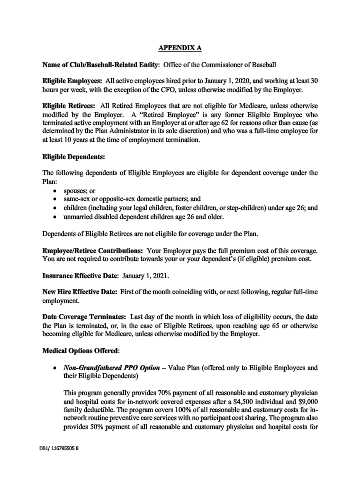

APPENDIX A

Name of Club/Baseball-Related Entity: Office of the Commissioner of Baseball

Eligible Employees: All active employees hired prior to January 1, 2020, and working at least 30

hours per week, with the exception of the CFO, unless otherwise modified by the Employer.

Eligible Retirees: All Retired Employees that are not eligible for Medicare, unless otherwise

modified by the Employer. A “Retired Employee” is any former Eligible Employee who

terminated active employment with an Employer at or after age 62 for reasons other than cause (as

determined by the Plan Administrator in its sole discretion) and who was a full-time employee for

at least 10 years at the time of employment termination.

Eligible Dependents:

The following dependents of Eligible Employees are eligible for dependent coverage under the

Plan:

• spouses; or

• same-sex or opposite-sex domestic partners; and

• children (including your legal children, foster children, or step-children) under age 26; and

• unmarried disabled dependent children age 26 and older.

Dependents of Eligible Retirees are not eligible for coverage under the Plan.

Employee/Retiree Contributions: Your Employer pays the full premium cost of this coverage.

You are not required to contribute towards your or your dependent’s (if eligible) premium cost.

Insurance Effective Date: January 1, 2021.

New Hire Effective Date: First of the month coinciding with, or next following, regular full-time

employment.

Date Coverage Terminates: Last day of the month in which loss of eligibility occurs, the date

the Plan is terminated, or, in the case of Eligible Retirees, upon reaching age 65 or otherwise

becoming eligible for Medicare, unless otherwise modified by the Employer.

Medical Options Offered:

• Non-Grandfathered PPO Option – Value Plan (offered only to Eligible Employees and

their Eligible Dependents)

This program generally provides 70% payment of all reasonable and customary physician

and hospital costs for in-network covered expenses after a $4,500 individual and $9,000

family deductible. The program covers 100% of all reasonable and customary costs for in-

network routine preventive care services with no participant cost sharing. The program also

provides 50% payment of all reasonable and customary physician and hospital costs for

DB1/ 116795505.8