Page 9 - Watermark Retirement Communities 2022 Benefits Guide Logan Square Union Before

P. 9

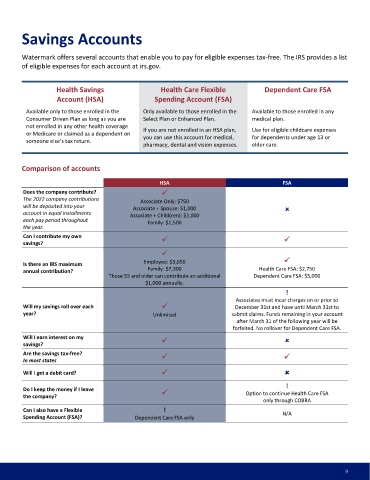

Savings Accounts

Watermark offers several accounts that enable you to pay for eligible expenses tax-free. The IRS provides a list

of eligible expenses for each account at irs.gov.

Health Savings Health Care Flexible Dependent Care FSA

Account (HSA) Spending Account (FSA)

Available only to those enrolled in the Only available to those enrolled in the Available to those enrolled in any

Consumer Driven Plan as long as you are Select Plan or Enhanced Plan. medical plan.

not enrolled in any other health coverage

If you are not enrolled in an HSA plan, Use for eligible childcare expenses

or Medicare or claimed as a dependent on you can use this account for medical, for dependents under age 13 or

someone else’s tax return.

pharmacy, dental and vision expenses. elder care.

Comparison of accounts

HSA FSA

Does the company contribute? ✓

The 2022 company contributions

Associate Only: $750

will be deposited into your Associate + Spouse: $1,000

account in equal installments Associate + Child(ren): $1,000

each pay period throughout

Family: $1,500

the year.

Can I contribute my own ✓ ✓

savings?

✓

Employee: $3,650 ✓

Is there an IRS maximum

annual contribution? Family: $7,300 Health Care FSA: $2,750

Those 55 and older can contribute an additional Dependent Care FSA: $5,000

$1,000 annually.

!

Associates must incur charges on or prior to

Will my savings roll over each ✓ December 31st and have until March 31st to

year? Unlimited submit claims. Funds remaining in your account

after March 31 of the following year will be

forfeited. No rollover for Dependent Care FSA.

Will I earn interest on my ✓

savings?

Are the savings tax-free? ✓ ✓

In most states

Will I get a debit card? ✓

!

Do I keep the money if I leave ✓

the company? Option to continue Health Care FSA

only through COBRA

Can I also have a Flexible ! N/A

Spending Account (FSA)? Dependent Care FSA only

9