Page 178 - Washington Nationals 2023 Benefits Guide -10.26.22_Neat

P. 178

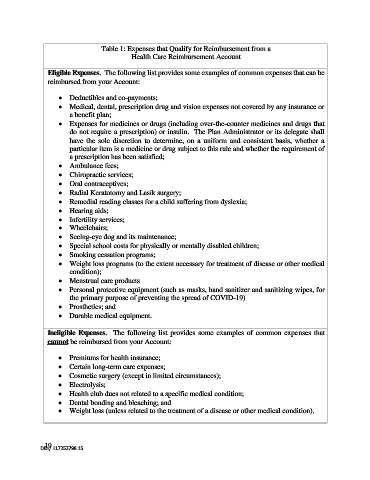

Table 1: Expenses that Qualify for Reimbursement from a

Health Care Reimbursement Account

Eligible Expenses. The following list provides some examples of common expenses that can be

reimbursed from your Account:

• Deductibles and co-payments;

• Medical, dental, prescription drug and vision expenses not covered by any insurance or

a benefit plan;

• Expenses for medicines or drugs (including over-the-counter medicines and drugs that

do not require a prescription) or insulin. The Plan Administrator or its delegate shall

have the sole discretion to determine, on a uniform and consistent basis, whether a

particular item is a medicine or drug subject to this rule and whether the requirement of

a prescription has been satisfied;

• Ambulance fees;

• Chiropractic services;

• Oral contraceptives;

• Radial Keratotomy and Lasik surgery;

• Remedial reading classes for a child suffering from dyslexia;

• Hearing aids;

• Infertility services;

• Wheelchairs;

• Seeing-eye dog and its maintenance;

• Special school costs for physically or mentally disabled children;

• Smoking cessation programs;

• Weight loss programs (to the extent necessary for treatment of disease or other medical

condition);

• Menstrual care products

• Personal protective equipment (such as masks, hand sanitizer and sanitizing wipes, for

the primary purpose of preventing the spread of COVID-19)

• Prosthetics; and

• Durable medical equipment.

Ineligible Expenses. The following list provides some examples of common expenses that

cannot be reimbursed from your Account:

• Premiums for health insurance;

• Certain long-term care expenses;

• Cosmetic surgery (except in limited circumstances);

• Electrolysis;

• Health club dues not related to a specific medical condition;

• Dental bonding and bleaching; and

• Weight loss (unless related to the treatment of a disease or other medical condition).

19

DB1/ 117253798.15