Page 249 - Washington Nationals 2023 Benefits Guide -10.26.22_Neat

P. 249

2 (additional) Dependents Life Insurance Benefit for your Spouse that exceeds the Guarantee

Issue Amount.

5. If your Child is eligible but not insured for additional Dependents Life Insurance, requirements

a. and c. above will be waived for your Child if you apply for additional Dependents Life Insurance

for your Child up to $10,000 during your Employer’s Annual Open Enrollment.

6. If your Child is insured for an amount of additional Dependents Life Insurance less than $10,000,

requirement f. above will be waived for your Child if you apply for an increase in additional

Dependents Life Insurance for your Child up to $10,000 during your Employer’s Annual Open

Enrollment.

Annual Enrollment Period means the period designated each year by your Employer when you may

change insurance elections.

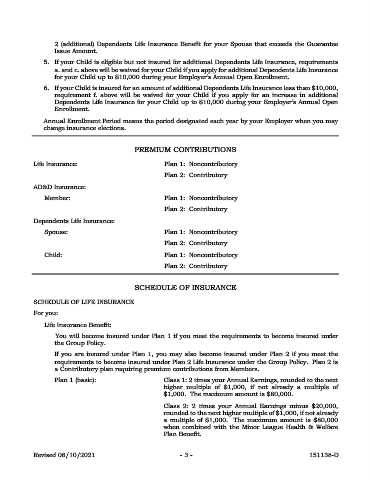

PREMIUM CONTRIBUTIONS

Life Insurance: Plan 1: Noncontributory

Plan 2: Contributory

AD&D Insurance:

Member: Plan 1: Noncontributory

Plan 2: Contributory

Dependents Life Insurance:

Spouse: Plan 1: Noncontributory

Plan 2: Contributory

Child: Plan 1: Noncontributory

Plan 2: Contributory

SCHEDULE OF INSURANCE

SCHEDULE OF LIFE INSURANCE

For you:

Life Insurance Benefit:

You will become insured under Plan 1 if you meet the requirements to become insured under

the Group Policy.

If you are insured under Plan 1, you may also become insured under Plan 2 if you meet the

requirements to become insured under Plan 2 Life Insurance under the Group Policy. Plan 2 is

a Contributory plan requiring premium contributions from Members.

Plan 1 (basic): Class 1: 2 times your Annual Earnings, rounded to the next

higher multiple of $1,000, if not already a multiple of

$1,000. The maximum amount is $80,000.

Class 2: 2 times your Annual Earnings minus $20,000,

rounded to the next higher multiple of $1,000, if not already

a multiple of $1,000. The maximum amount is $80,000

when combined with the Minor League Health & Welfare

Plan Benefit.

Revised 08/10/2021 - 3 - 151138-D