Page 85 - 2023 Hickory Crawdads - Benefits Guide_Neat

P. 85

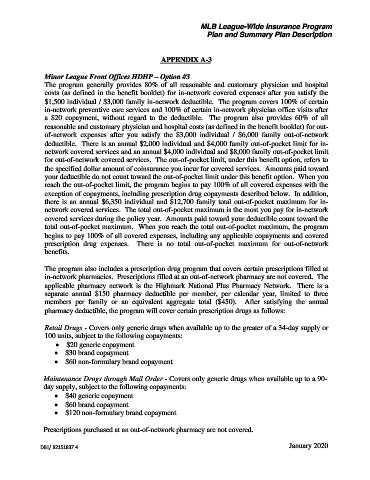

MLB League-Wide Insurance Program

Plan and Summary Plan Description

APPENDIX A-3

Minor League Front Offices HDHP – Option #3

The program generally provides 80% of all reasonable and customary physician and hospital

costs (as defined in the benefit booklet) for in-network covered expenses after you satisfy the

$1,500 individual / $3,000 family in-network deductible. The program covers 100% of certain

in-network preventive care services and 100% of certain in-network physician office visits after

a $20 copayment, without regard to the deductible. The program also provides 60% of all

reasonable and customary physician and hospital costs (as defined in the benefit booklet) for out-

of-network expenses after you satisfy the $3,000 individual / $6,000 family out-of-network

deductible. There is an annual $2,000 individual and $4,000 family out-of-pocket limit for in-

network covered services and an annual $4,000 individual and $8,000 family out-of-pocket limit

for out-of-network covered services. The out-of-pocket limit, under this benefit option, refers to

the specified dollar amount of coinsurance you incur for covered services. Amounts paid toward

your deductible do not count toward the out-of-pocket limit under this benefit option. When you

reach the out-of-pocket limit, the program begins to pay 100% of all covered expenses with the

exception of copayments, including prescription drug copayments described below. In addition,

there is an annual $6,350 individual and $12,700 family total out-of-pocket maximum for in-

network covered services. The total out-of-pocket maximum is the most you pay for in-network

covered services during the policy year. Amounts paid toward your deductible count toward the

total out-of-pocket maximum. When you reach the total out-of-pocket maximum, the program

begins to pay 100% of all covered expenses, including any applicable copayments and covered

prescription drug expenses. There is no total out-of-pocket maximum for out-of-network

benefits.

The program also includes a prescription drug program that covers certain prescriptions filled at

in-network pharmacies. Prescriptions filled at an out-of-network pharmacy are not covered. The

applicable pharmacy network is the Highmark National Plus Pharmacy Network. There is a

separate annual $150 pharmacy deductible per member, per calendar year, limited to three

members per family or an equivalent aggregate total ($450). After satisfying the annual

pharmacy deductible, the program will cover certain prescription drugs as follows:

Retail Drugs - Covers only generic drugs when available up to the greater of a 34-day supply or

100 units, subject to the following copayments:

• $20 generic copayment

• $30 brand copayment

• $60 non-formulary brand copayment

Maintenance Drugs through Mail Order - Covers only generic drugs when available up to a 90-

day supply, subject to the following copayments:

• $40 generic copayment

• $60 brand copayment

• $120 non-formulary brand copayment

Prescriptions purchased at an out-of-network pharmacy are not covered.

DB1/ 82151837.4 January 2020