Page 11 - Avatar 2022 Flipbook

P. 11

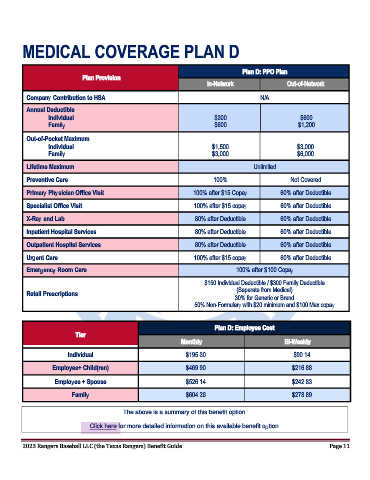

MEDICAL COVERAGE PLAN D

Plan D: PPO Plan

Plan Provision

In-Network Out-of-Network

Company Contribution to HSA N/A

Annual Deductible

Individual $300 $600

Family $600 $1,200

Out-of-Pocket Maximum

Individual $1,500 $3,000

Family $3,000 $6,000

Lifetime Maximum Unlimited

Preventive Care 100% Not Covered

Primary Physician Office Visit 100% after $15 Copay 60% after Deductible

Specialist Office Visit 100% after $15 copay 60% after Deductible

X-Ray and Lab 80% after Deductible 60% after Deductible

Inpatient Hospital Services 80% after Deductible 60% after Deductible

Outpatient Hospital Services 80% after Deductible 60% after Deductible

Urgent Care 100% after $15 copay 60% after Deductible

Emergency Room Care 100% after $100 Copay

$150 Individual Deductible / $300 Family Deductible

(Separate from Medical)

Retail Prescriptions

30% for Generic or Brand

50% Non-Formulary with $20 minimum and $100 Max copay

Plan D: Employee Cost

Tier

Monthly Bi-Weekly

Individual $195.30 $90.14

Employee+ Child(ren) $469.90 $216.88

Employee + Spouse $526.14 $242.83

Family $604.26 $278.89

The above is a summary of this benefit option.

Click here for more detailed information on this available benefit option.

2023 Rangers Baseball LLC (the Texas Rangers) Benefit Guide Page 11