Page 16 - Peak Technologies 2023 Benefit Guide

P. 16

Flexible Spending Account (FSA)

Account Available to you:

• Healthcare FSA (with Debit Card) with $610 rolloverrate

• Dependent Care FSA

Eligibility:

When you use FSAs you can use tax-free dollars to pay for:

• Most medical,dentalandvisioncare expenseslikeco-payments, deductiblesandcoinsurance

• Over-the-counterdrugs–these itemsare ineligibleexpensesunlessyouhaveaprescription fromyourphysician

• Dependentcare (forchildrenunder13yearsoldand/orparentsordependents thatcannotcare forthemselves)

suchas day care programs, babysitters, after-schoolprograms, andadultday programs

Using tax-free dollars means that you spend less for these things and have more money to spend on other things that you

want and need.

Saving Money with Flexible Spending Accounts

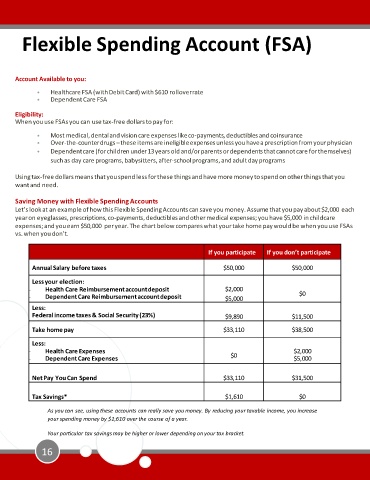

Let’s look at an example of how this Flexible Spending Accounts can save you money. Assume that you pay about $2,000 each

year on eyeglasses, prescriptions, co-payments, deductibles and other medical expenses; you have $5,000 in childcare

expenses; and you earn $50,000 per year. The chart below compares what your take home pay would be when you use FSAs

vs. when you don’t.

If you participate If you don’t participate

Annual Salary before taxes $50,000 $50,000

Less your election:

- Health Care Reimbursement accountdeposit $2,000 $0

- Dependent Care Reimbursement accountdeposit $5,000

Less:

Federal income taxes & Social Security (23%) $9,890 $11,500

Take home pay $33,110 $38,500

Less:

- Health Care Expenses $0 $2,000

- Dependent Care Expenses $5,000

Net Pay You Can Spend $33,110 $31,500

Tax Savings* $1,610 $0

As you can see, using these accounts can really save you money. By reducing your taxable income, you increase

your spending money by $1,610 over the course of a year.

Your particular tax savings may be higher or lower depending on your tax bracket.

16