Page 180 - Washington Nationals 2023 Benefits Guide -10.26.22_Neat

P. 180

The federal government publishes a booklet (Publication 502) listing the expenses that may be

eligible for reimbursement through the Health Care Reimbursement Account. You can request a

copy from your local Internal Revenue Service Office listed under the U.S. Government Offices

in your telephone book or find it on the Internet at www.irs.gov/forms_pubs/indes.html. If you are

a military reservist called to active duty for a period in excess of 179 days or for an indefinite

period, you may request a distribution from your Health Care Reimbursement Account. You must

make the distribution during the period beginning on the date of your call-up and ending on the

last date that reimbursements could otherwise be made for that Plan Year. The amount you

contributed to the Health Care Reimbursement Account minus Health Care Reimbursement

Account reimbursements received as of the date of the Qualified Reservist Distribution request

can be withdrawn.

Dependent Care Assistance Account

The Flex Plan will establish a Dependent Care Assistance Account in your name if you elect to

contribute to such an account. The Dependent Care Assistance Account will be credited with your

contributions and will be reduced by any payments made on your behalf. You will be entitled to

receive reimbursement from this account for dependent care assistance. “Dependent care

assistance” is defined as expenses you incur for the care of a qualifying individual. A “qualifying

individual” for this purpose includes:

• your child, grandchild, brother or sister who is under age 13 (or under age 14 if such child

attained the age of 13 (i) during the 2020 Plan Year or (ii) during the 2021 Plan Year and

if there is any unused balance in your Dependent Care Assistance Account at the end of

the 2020 Plan Year), who resides in your household for more than one-half of the year and

who does not provide more than one-half of his or her own support for the year (if you are

divorced or separated, certain qualifications and special custody/support rules may apply);

• a disabled spouse who resides in your household for more than one-half of the year; and

• a disabled relative or household member who is principally dependent on you for support

and who resides in your household for more than one-half of the year.

Note: A disabled Dependent must spend at least eight hours a day in your home. A disabled

Dependent who is confined to an institution for care would not qualify.

Expenses only qualify for reimbursement if they allow you to be gainfully employed. If you are

married, your spouse must also be employed (or seeking employment), enrolled as a full-time

student, or disabled for your expenses to qualify. Expenses incurred while you are not working

(e.g., sick day, vacation, etc.) do not qualify for reimbursement. However, expenses incurred

during certain “short” or “temporary” absences for illness or vacation may be eligible for

reimbursement if you are required to pay for dependent care on a weekly or longer basis. Also, if

you work part-time, you do not have to allocate expenses between time worked and time not

worked if you are required to pay for care on a weekly or longer basis.

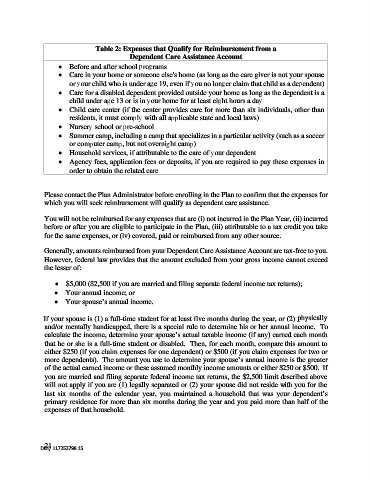

Not all expenses qualify as dependent care assistance. Only expenses that are excludable from

income under federal tax may qualify as dependent care assistance. See Table 2, below, for some

examples of expenses that qualify.

20

DB1/ 117253798.15