Page 11 - 2022 Mersen Benefit Guide

P. 11

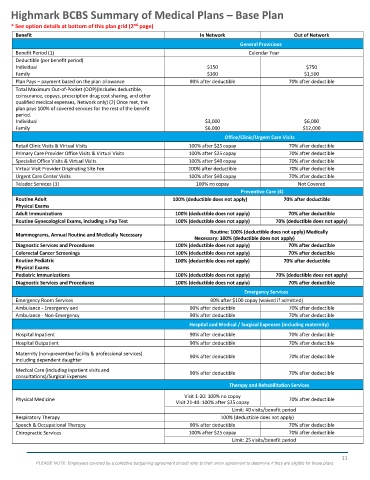

Highmark BCBS Summary of Medical Plans – Base Plan

nd

* See o ption details at bottom of this plan grid (2 page)

Benefit In Network Out of Network

During 2023 open enrollment, the Base Plan will only be available to active employees that selected this plan for the 2022 benefit

General Provisions

plan year. Calendar Year

Benefit Period (1)

Deductible (per benefit period) $150 $750

Individual

Family $300 $1,500

Plan Pays – payment based on the plan allowance 90% after deductible 70% after deductible

Total Maximum Out-of-Pocket (OOP)(Includes deductible,

coinsurance, copays, prescription drug cost sharing, and other

qualified medical expenses, Network only) (2) Once met, the

plan pays 100% of covered services for the rest of the benefit

period.

Individual $3,000 $6,000

Family $6,000 $12,000

Office/Clinic/Urgent Care Visits

Retail Clinic Visits & Virtual Visits 100% after $25 copay 70% after deductible

Primary Care Provider Office Visits & Virtual Visits 100% after $25 copay 70% after deductible

Specialist Office Visits & Virtual Visits 100% after $40 copay 70% after deductible

Virtual Visit Provider Originating Site Fee 100% after deductible 70% after deductible

Urgent Care Center Visits 100% after $40 copay 70% after deductible

Teladoc Services (3) 100% no copay Not Covered

Preventive Care (4)

Routine Adult 100% (deductible does not apply) 70% after deductible

Physical Exams

Adult Immunizations 100% (deductible does not apply) 70% after deductible

Routine Gynecological Exams, including a Pap Test 100% (deductible does not apply) 70% (deductible does not apply)

Routine: 100% (deductible does not apply) Medically

Mammograms, Annual Routine and Medically Necessary

Necessary: 100% (deductible does not apply)

Diagnostic Services and Procedures 100% (deductible does not apply) 70% after deductible

Colorectal Cancer Screenings 100% (deductible does not apply) 70% after deductible

Routine Pediatric 100% (deductible does not apply) 70% after deductible

Physical Exams

Pediatric Immunizations 100% (deductible does not apply) 70% (deductible does not apply)

Diagnostic Services and Procedures 100% (deductible does not apply) 70% after deductible

Emergency Services

Emergency Room Services 90% after $100 copay (waived if admitted)

Ambulance - Emergency and 90% after deductible 70% after deductible

Ambulance - Non-Emergency 90% after deductible 70% after deductible

Hospital and Medical / Surgical Expenses (including maternity)

Hospital Inpatient 90% after deductible 70% after deductible

Hospital Outpatient 90% after deductible 70% after deductible

Maternity (non-preventive facility & professional services) 90% after deductible 70% after deductible

including dependent daughter

Medical Care (including inpatient visits and 90% after deductible 70% after deductible

consultations)/Surgical Expenses

Therapy and Rehabilitation Services

Visit 1-20: 100% no copay

Physical Medicine 70% after deductible

Visit 21-40: 100% after $25 copay

Limit: 40 visits/benefit period

Respiratory Therapy 100% (deductible does not apply)

Speech & Occupational Therapy 90% after deductible 70% after deductible

Chiropractic Services 100% after $25 copay 70% after deductible

Limit: 25 visits/benefit period

11

PLEASE NOTE: Employees covered by a collective bargaining agreement should refer to their union agreement to determine if they are eligible for these plans.