Page 106 - FY 2021-22 Adopted Budget file_Neat

P. 106

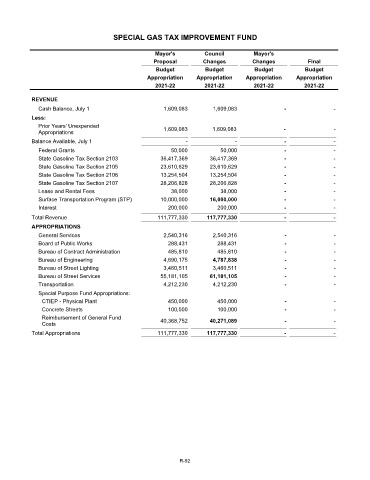

SPECIAL GAS TAX IMPROVEMENT FUND

Mayor's Council Mayor's

Proposal Changes Changes Final

Budget Budget Budget Budget

Appropriation Appropriation Appropriation Appropriation

2021-22 2021-22 2021-22 2021-22

REVENUE

Cash Balance, July 1 1,609,083 1,609,083 - -

Less:

Prior Years' Unexpended 1,609,083 1,609,083 - -

Appropriations

Balance Available, July 1 - - - -

Federal Grants 50,000 50,000 - -

State Gasoline Tax Section 2103 36,417,369 36,417,369 - -

State Gasoline Tax Section 2105 23,610,629 23,610,629 - -

State Gasoline Tax Section 2106 13,254,504 13,254,504 - -

State Gasoline Tax Section 2107 28,206,828 28,206,828 - -

Lease and Rental Fees 38,000 38,000 - -

Surface Transportation Program (STP) 10,000,000 16,000,000 - -

Interest 200,000 200,000 - -

Total Revenue 111,777,330 117,777,330 - -

APPROPRIATIONS

General Services 2,540,316 2,540,316 - -

Board of Public Works 288,431 288,431 - -

Bureau of Contract Administration 485,810 485,810 - -

Bureau of Engineering 4,690,175 4,787,838 - -

Bureau of Street Lighting 3,460,511 3,460,511 - -

Bureau of Street Services 55,181,105 61,181,105 - -

Transportation 4,212,230 4,212,230 - -

Special Purpose Fund Appropriations:

CTIEP - Physical Plant 450,000 450,000 - -

Concrete Streets 100,000 100,000 - -

Reimbursement of General Fund 40,368,752 40,271,089 - -

Costs

Total Appropriations 111,777,330 117,777,330 - -

R-92