Page 20 - Kirkland Court 2024 Benefit Guide

P. 20

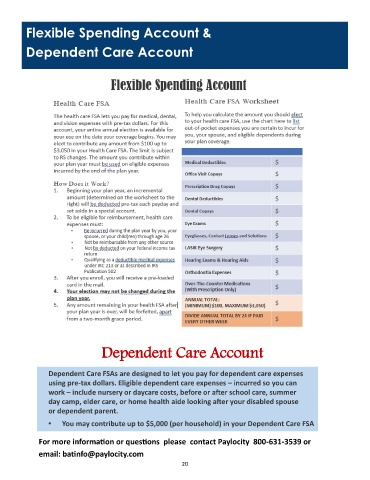

Flexible Spending Account &

Dependent Care Account

Dependent Care Account

Dependent Care FSAs are designed to let you pay for dependent care expenses

using pre-tax dollars. Eligible dependent care expenses – incurred so you can

work – include nursery or daycare costs, before or after school care, summer

day camp, elder care, or home health aide looking after your disabled spouse

or dependent parent.

• You may contribute up to $5,000 (per household) in your Dependent Care FSA

For more information or questions please contact Paylocity 800-631-3539 or

email: batinfo@paylocity.com

20