Page 21 - Crosbyton 2024 Benefit Guide

P. 21

Life / AD&D Insurance:

Guardian

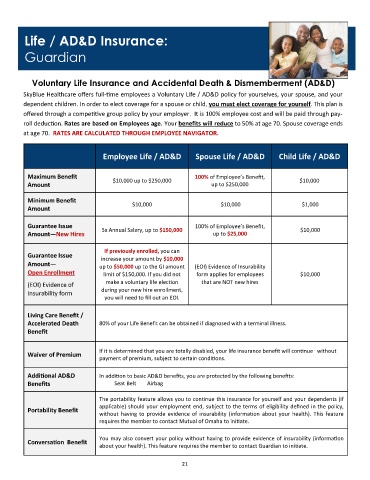

Voluntary Life Insurance and Accidental Death & Dismemberment (AD&D)

SkyBlue Healthcare offers full-time employees a Voluntary Life / AD&D policy for yourselves, your spouse, and your

dependent children. In order to elect coverage for a spouse or child, you must elect coverage for yourself. This plan is

offered through a competitive group policy by your employer. It is 100% employee cost and will be paid through pay-

roll deduction. Rates are based on Employees age. Your benefits will reduce to 50% at age 70. Spouse coverage ends

at age 70. RATES ARE CALCULATED THROUGH EMPLOYEE NAVIGATOR.

Employee Life / AD&D Spouse Life / AD&D Child Life / AD&D

Maximum Benefit 100% of Employee’s Benefit,

$10,000 up to $250,000 $10,000

Amount up to $250,000

Minimum Benefit

$10,000 $10,000 $1,000

Amount

Guarantee Issue 100% of Employee’s Benefit,

Amount—New Hires 5x Annual Salary, up to $150,000 up to $25,000 $10,000

If previously enrolled, you can

Guarantee Issue

increase your amount by $10,000

Amount—

up to $50,000 up to the GI amount (EOI) Evidence of Insurability

Open Enrollment limit of $150,000. If you did not form applies for employees $10,000

(EOI) Evidence of make a voluntary life election that are NOT new hires

during your new hire enrollment,

Insurability form

you will need to fill out an EOI.

Living Care Benefit /

Accelerated Death 80% of your Life Benefit can be obtained if diagnosed with a terminal illness.

Benefit

If it is determined that you are totally disabled, your life insurance benefit will continue without

Waiver of Premium

payment of premium, subject to certain conditions.

Additional AD&D In addition to basic AD&D benefits, you are protected by the following benefits:

Benefits Seat Belt Airbag

The portability feature allows you to continue this insurance for yourself and your dependents (if

applicable) should your employment end, subject to the terms of eligibility defined in the policy,

Portability Benefit

without having to provide evidence of insurability (information about your health). This feature

requires the member to contact Mutual of Omaha to initiate.

You may also convert your policy without having to provide evidence of insurability (information

Conversation Benefit

about your health). This feature requires the member to contact Guardian to initiate.

21