Page 20 - Summit LTC Management LLC_Benefit Guide_GROUP 2 2019-2020_Revised 10-1-2020

P. 20

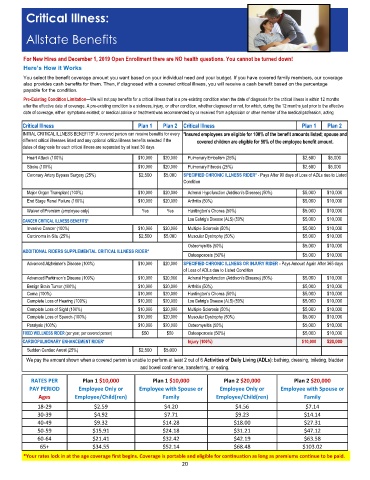

Critical Illness:

Allstate Benefits

For New Hires and December 1, 2019 Open Enrollment there are NO health questions. You cannot be turned down!

Here’s How it Works

You select the benefit coverage amount you want based on your individual need and your budget. If you have covered family members, our coverage

also provides cash benefits for them. Then, if diagnosed with a covered critical illness, you will receive a cash benefit based on the percentage

payable for the condition.

Pre-Existing Condition Limitation—We will not pay benefits for a critical illness that is a pre-existing condition when the date of diagnosis for the critical illness is within 12 months

after the effective date of coverage. A pre-existing condition is a sickness, injury, or other condition, whether diagnosed or not, for which, during the 12 months just prior to the effective

date of coverage, either: symptoms existed; or medical advice or treatment was recommended by or received from a physician or other member of the medical profession, acting

INITIAL CRITICAL ILLNESS BENEFITS* A covered person can receive benefits for every

different critical illnesses listed and any optional critical illness benefits selected if the

dates of diagnosis for each critical illness are separated by at least 30 days.

Heart Attack (100%) $10,000 $20,000 Pulmonary Embolism (25%)

Stroke (100%) $10,000 $20,000 Pulmonary Fibrosis (25%)

Coronary Artery Bypass Surgery (25%) SPECIFIED CHRONIC ILLNESS RIDER* - Pays After 90 days of Loss of ADLs due to Listed

Condition

Major Organ Transplant (100%) $10,000 $20,000 Adrenal Hypofunction (Addison’s Disease) (50%)

End Stage Renal Failure (100%) $10,000 $20,000 Arthritis (50%)

Waiver of Premium (employee only) Yes Yes Huntington’s Chorea (50%)

Invasive Cancer (100%) $10,000 $20,000 Multiple Sclerosis (50%)

Carcinoma in Situ (25%) Muscular Dystrophy (50%)

Osteomyelitis (50%)

ADDITIONAL RIDERS SUPPLEMENTAL CRITICAL ILLNESS RIDER*

Advanced Alzheimer’s Disease (100%) $10,000 $20,000 SPECIFIED CHRONIC ILLNESS OR INJURY RIDER - Pays Amount Again After 365 days

of Loss of ADLs due to Listed Condition

Advanced Parkinson’s Disease (100%) $10,000 $20,000 Adrenal Hypofunction (Addison’s Disease) (50%)

Benign Brain Tumor (100%) $10,000 $20,000 Arthritis (50%)

Coma (100%) $10,000 $20,000 Huntington’s Chorea (50%)

Complete Loss of Hearing (100%) $10,000 $20,000

Complete Loss of Sight (100%) $10,000 $20,000 Multiple Sclerosis (50%)

Complete Loss of Speech (100%) $10,000 $20,000 Muscular Dystrophy (50%)

Paralysis (100%) $10,000 $20,000 Osteomyelitis (50%)

$50

Injury (100%) $10,000

Sudden Cardiac Arrest (25%)

We pay the amount shown when a covered person is unable to perform at least 2 out of 6 Activities of Daily Living (ADLs): bathing, dressing, toileting, bladder

and bowel continence, transferring, or eating.

RATES PER Plan 1 $10,000 Plan 1 $10,000 Plan 2 $20,000 Plan 2 $20,000

PAY PERIOD Employee Only or Employee with Spouse or Employee Only or Employee with Spouse or

Ages Employee/Child(ren) Family Employee/Child(ren) Family

18-29 $2.59 $4.20 $4.56 $7.14

30-39 $4.92 $7.71 $9.23 $14.14

40-49 $9.32 $14.28 $18.00 $27.31

50-59 $15.91 $24.18 $31.21 $47.12

60-64 $21.41 $32.42 $42.19 $63.58

65+ $34.55 $52.14 $68.48 $103.02

*Your rates lock in at the age coverage first begins. Coverage is portable and eligible for continuation as long as premiums continue to be paid.

20