Page 9 - Compliance Monthly - December 2019

P. 9

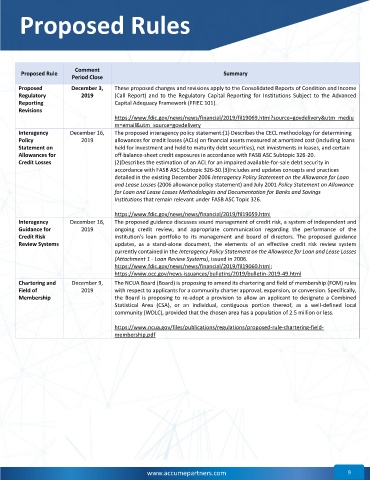

Proposed Rules

Comment

Proposed Rule Summary

Period Close

Proposed December 3, These proposed changes and revisions apply to the Consolidated Reports of Condition and Income

Regulatory 2019 (Call Report) and to the Regulatory Capital Reporting for Institutions Subject to the Advanced

Reporting Capital Adequacy Framework (FFIEC 101).

Revisions

https://www.fdic.gov/news/news/financial/2019/fil19069.html?source=govdelivery&utm_mediu

m=email&utm_source=govdelivery

Interagency December 16, The proposed interagency policy statement:(1) Describes the CECL methodology for determining

Policy 2019 allowances for credit losses (ACLs) on financial assets measured at amortized cost (including loans

Statement on held for investment and held to maturity debt securities), net investments in leases, and certain

Allowances for off-balance-sheet credit expo sures in accordance with FASB ASC Subtopic 326-20.

Credit Losses (2)Describes the estimation of an ACL for an impaired available-for-sale debt security in

accordance with FASB ASC Subtopic 326-30.(3)Includes and updates concepts and practices

detailed in the existing December 2006 Interagency Policy Statement on the Allowance for Loan

and Lease Losses (2006 allowance policy statement) and July 2001 Policy Statement on Allowance

for Loan and Lease Losses Methodologies and Documentation for Banks and Savings

Institutions that remain relevant under FASB ASC Topic 326.

https://www.fdic.gov/news/news/financial/2019/fil19059.html

Interagency December 16, The proposed guidance discusses sound management of credit risk, a system of independent and

Guidance for 2019 ongoing credit review, and appropriate communication regarding the performance of the

Credit Risk institution's loan portfolio to its management and board of directors. The proposed guidance

Review Systems updates, as a stand-alone document, the elements of an effective credit risk review system

currently contained in the Interagency Policy Statement on the Allowance for Loan and Lease Losses

(Attachment 1 - Loan Review Systems), issued in 2006.

https://www.fdic.gov/news/news/financial/2019/fil19060.html;

https://www.occ.gov/news-issuances/bulletins/2019/bulletin-2019-49.html

Chartering and December 9, The NCUA Board (Board) is proposing to amend its chartering and field of membership (FOM) rules

Field of 2019 with respect to applicants for a community charter approval, expansion, or conversion. Specifically,

Membership the Board is proposing to re-adopt a provision to allow an applicant to designate a Combined

Statistical Area (CSA), or an individual, contiguous portion thereof, as a well-defined local

community (WDLC), provided that the chosen area has a population of 2.5 million or less.

https://www.ncua.gov/files/publications/regulations/proposed-rule-chartering-field-

membership.pdf

www.accumepartners.com 9