Page 34 - ABC Company 2018 Open Enrollment Guide

P. 34

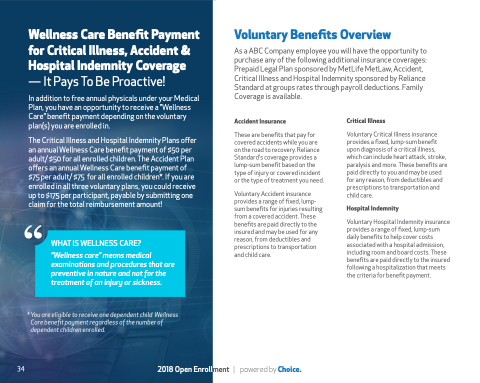

Wellness Care Benefit Payment for Critical Illness, Accident & Hospital Indemnity Coverage — It Pays To Be Proactive!

In addition to free annual physicals under your Medical Plan, you have an opportunity to receive a “Wellness Care” benefit payment depending on the voluntary plan(s) you are enrolled in.

The Critical Illness and Hospital Indemnity Plans offer an annual Wellness Care benefit payment of $50 per adult/ $50 for all enrolled children. The Accident Plan offers an annual Wellness Care benefit payment of $75 per adult/ $75 for all enrolled children*. If you are enrolled in all three voluntary plans, you could receive up to $175 per participant, payable by submitting one claim for the total reimbursement amount!

WHAT IS WELLNESS CARE?

“Wellness care” means medical examinations and procedures that are preventive in nature and not for the treatment of an injury or sickness.

* You are eligible to receive one dependent child Wellness Care benefit payment regardless of the number of dependent children enrolled.

34

2018 Open Enroll

Voluntary Benefits Overview

As a ABC Company employee you will have the opportunity to purchase any of the following additional insurance coverages: Prepaid Legal Plan sponsored by MetLife MetLaw, Accident, Critical Illness and Hospital Indemnity sponsored by Reliance Standard at groups rates through payroll deductions. Family Coverage is available.

Accident Insurance

These are benefits that pay for covered accidents while you are on the road to recovery. Reliance Standard's coverage provides a lump-sum benefit based on the type of injury or covered incident or the type of treatment you need.

Voluntary Accident insurance provides a range of fixed, lump- sum benefits for injuries resulting from a covered accident. These benefits are paid directly to the insured and may be used for any reason, from deductibles and prescriptions to transportation and child care.

Critical Illness

Voluntary Critical Illness insurance provides a fixed, lump-sum benefit upon diagnosis of a critical illness, which can include heart attack, stroke, paralysis and more. These benefits are paid directly to you and may be used for any reason, from deductibles and prescriptions to transportation and child care.

Hospital Indemnity

Voluntary Hospital Indemnity insurance provides a range of fixed, lump-sum daily benefits to help cover costs associated with a hospital admission, including room and board costs. These benefits are paid directly to the insured following a hospitalization that meets the criteria for benefit payment.

ment | powered by Choice.