Page 11 - Skechers 2022 Benefits Guide

P. 11

DEPENDENT VERIFICATION

You will need your dependent information, including Date of Birth and Social Security Number, for each of the dependents you wish to enroll.

You will also need to provide document substantiation for each dependent you enroll. Below is a list of documents we will accept.

Legal Spouse – Government issued Marriage Certificate showing date of marriage OR most recent tax return naming spouse.

Domestic Partner* – Domestic partner affidavit (located in the Reference Center. See 'More Info' section of this benefits guide) OR State Declaration of Domestic Partnership registration.

Child Under 26 Years Old – Government issued Birth Certificate naming you as parent OR Hospital documentation reflecting the child’s birth, naming you as parent OR most recent tax return naming child as a dependent.

Stepchild Under 26 Years Old – Government issued Birth Certificate naming your spouse as parent AND Government issued Marriage Certificate showing your marriage to the child’s parent OR most recent tax return naming the stepchild as your dependent.

Child (of a Domestic Partner) Under 26 Years Old – Domestic Partner affidavit (located in the Reference Center) OR State Declaration of Domestic Partnership registration showing your Domestic Partnership with the child’s parent AND government issued Birth Certificate naming your Domestic Partner as parent OR most recent tax return of domestic partner naming the child as a dependent.

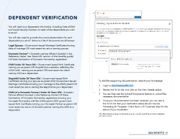

To add the supporting documentation, start at your homepage

1. Login to skechersbenefits.com.

2. Review the To Do list, and click on the View Details option.

3. You can then use the Upload Documents feature to upload the necessary documentation.

4. Once your documentation has been received, you can see in the To Do list that your verification status should now be Processing (In Progress). Check back in 5-7 business days for the status of your transaction.

*The IRS considers coverage for domestic partners a taxable benefit that must be included in your gross income.

2022 BENEFITS 11