Page 23 - KIPP NYC 2022 Benfits Summary

P. 23

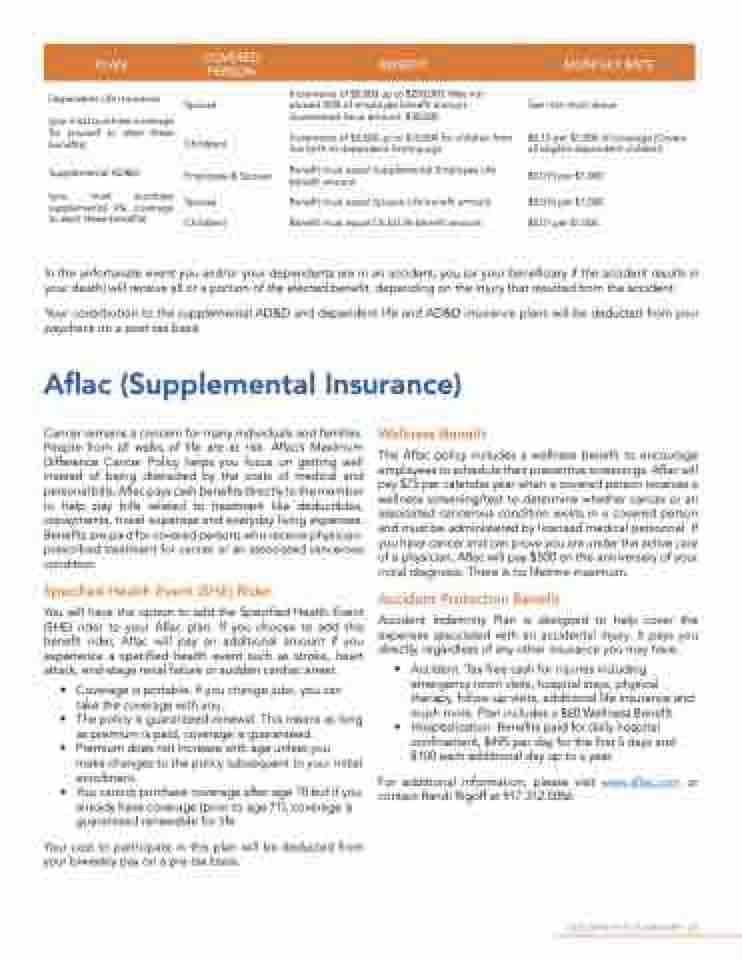

PLAN

COVERED PERSON

BENEFIT

MONTHLY RATE

Dependent Life Insurance

(you must purchase coverage for yourself to elect these benefits)

Supplemental AD&D

(you must purchase supplemental life coverage to elect these benefits)

Spouse

Child(ren)

Employee & Spouse

Spouse

Child(ren)

Increments of $5,000 up to $250,000. May not exceed 50% of employee benefit amount. Guaranteed Issue amount: $30,000

Increments of $2,000 up to $10,000 for children from live birth to dependent limiting age

Benefit must equal Supplemental Employee Life benefit amount

Benefit must equal Spouse Life benefit amount

Benefit must equal Child Life benefit amount

See rate chart above

$0.12 per $1,000 of coverage (Covers all eligible dependent children)

$0.015 per $1,000

$0.015 per $1,000

$0.01 per $1,000

In the unfortunate event you and/or your dependents are in an accident, you (or your beneficiary if the accident results in your death) will receive all or a portion of the elected benefit, depending on the injury that resulted from the accident.

Your contribution to the supplemental AD&D and dependent life and AD&D insurance plans will be deducted from your paycheck on a post-tax basis.

Aflac (Supplemental Insurance)

Wellness Benefit

The Aflac policy includes a wellness benefit to encourage employees to schedule their preventive screenings. Aflac will pay $75 per calendar year when a covered person receives a wellness screening/test to determine whether cancer or an associated cancerous condition exists in a covered person and must be administered by licensed medical personnel. If you have cancer and can prove you are under the active care of a physician, Aflac will pay $500 on the anniversary of your initial diagnosis. There is no lifetime maximum.

Accident Protection Benefit

Accident Indemnity Plan is designed to help cover the expenses associated with an accidental injury. It pays you directly, regardless of any other insurance you may have.

• Accident: Tax-free cash for injuries including emergency room visits, hospital stays, physical therapy, follow-up visits, additional life insurance and much more. Plan includes a $60 Wellness Benefit.

• Hospitalization: Benefits paid for daily hospital confinement, $495 per day for the first 5 days and $100 each additional day up to a year.

For additional information, please visit www.aflac.com or contact Randi Rigoff at 917.312.5056.

Cancer remains a concern for many individuals and families. People from all walks of life are at risk. Aflac’s Maximum Difference Cancer Policy helps you focus on getting well instead of being distracted by the costs of medical and personal bills, Aflac pays cash benefits directly to the member to help pay bills related to treatment like deductibles, copayments, travel expenses and everyday living expenses. Benefits are paid for covered persons who receive physician- prescribed treatment for cancer or an associated cancerous condition.

Specified Health Event (SHE) Rider

You will have the option to add the Specified Health Event (SHE) rider to your Aflac plan. If you choose to add this benefit rider, Aflac will pay an additional amount if you experience a specified health event such as stroke, heart attack, end-stage renal failure or sudden cardiac arrest.

• Coverage is portable. If you change jobs, you can take the coverage with you.

• The policy is guaranteed-renewal. This means as long as premium is paid, coverage is guaranteed.

• Premium does not increase with age unless you make changes to the policy subsequent to your initial enrollment.

• You cannot purchase coverage after age 70 but if you already have coverage (prior to age 71), coverage is guaranteed renewable for life.

Your cost to participate in this plan will be deducted from your biweekly pay on a pre-tax basis.

2022 BENEFITS SUMMARY 23