Page 17 - 2020 McLennan County Benefits Enrollment Guide

P. 17

Income Protection & Voluntary Benefits

Life Insurance Employer Paid – Dearborn National

McLennan County pays for and provides eligible employees with $10,000 of life insurance and $10,000 of accidental

death & dismemberment insurance payable to the beneficiary of your choice. At age 65, 70, 75 and 80 there is a

reduction in the amount of insurance coverage. You may change your beneficiary at any time. You do not have to wait

until open enrollment to change your beneficiary. To change your beneficiary outside of the open enrollment period or

to review additional plan details, please notify a member of the Human Resources Team.

Voluntary Life Insurance Employee Paid

Dearborn National

The death of a family member can mean not only dealing with the loss of a loved one, but the loss of financial security as

well. With Dearborn National Life Insurance Company's Group Term Life plan, an employee can achieve peace of mind

by giving their family the financial security they can depend on. Please see the plan policy for specifics.

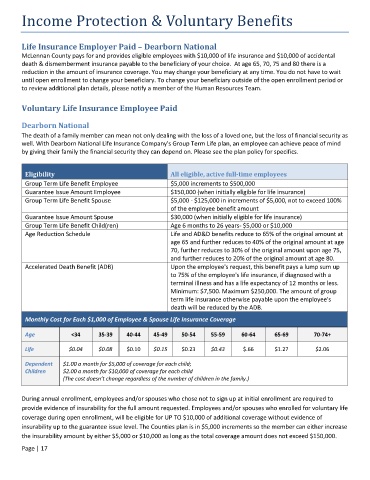

Eligibility All eligible, active full-time employees

Group Term Life Benefit Employee $5,000 increments to $500,000

Guarantee Issue Amount Employee $150,000 (when initially eligible for life insurance)

Group Term Life Benefit Spouse $5,000 - $125,000 in increments of $5,000, not to exceed 100%

of the employee benefit amount

Guarantee Issue Amount Spouse $30,000 (when initially eligible for life insurance)

Group Term Life Benefit Child(ren) Age 6 months to 26 years- $5,000 or $10,000

Age Reduction Schedule Life and AD&D benefits reduce to 65% of the original amount at

age 65 and further reduces to 40% of the original amount at age

70, further reduces to 30% of the original amount upon age 75,

and further reduces to 20% of the original amount at age 80.

Accelerated Death Benefit (ADB) Upon the employee's request, this benefit pays a lump sum up

to 75% of the employee's life insurance, if diagnosed with a

terminal illness and has a life expectancy of 12 months or less.

Minimum: $7,500. Maximum $250,000. The amount of group

term life insurance otherwise payable upon the employee's

death will be reduced by the ADB.

Monthly Cost for Each $1,000 of Employee & Spouse Life Insurance Coverage

Age <34 35-39 40-44 45-49 50-54 55-59 60-64 65-69 70-74+

Life $0.04 $0.08 $0.10 $0.15 $0.23 $0.43 $.66 $1.27 $2.06

Dependent $1.00 a month for $5,000 of coverage for each child;

Children $2.00 a month for $10,000 of coverage for each child

(The cost doesn’t change regardless of the number of children in the family.)

During annual enrollment, employees and/or spouses who chose not to sign up at initial enrollment are required to

provide evidence of insurability for the full amount requested. Employees and/or spouses who enrolled for voluntary life

coverage during open enrollment, will be eligible for UP TO $10,000 of additional coverage without evidence of

insurability up to the guarantee issue level. The Counties plan is in $5,000 increments so the member can either increase

the insurability amount by either $5,000 or $10,000 as long as the total coverage amount does not exceed $150,000.

Page | 17