Page 79 - Beeks Financial Cloud Group Annual Report 2021

P. 79

Beeks Financial Cloud Group PLC

Notes to the Consolidated Financial Statements For the year ended 30 June 2021

2021 2020

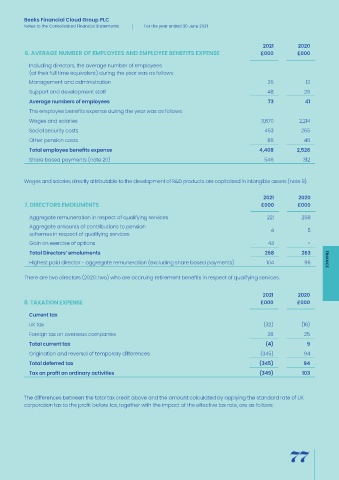

6. AVERAGE NUMBER OF EMPLOYEES AND EMPLOYEE BENEFITS EXPENSE £000 £000

Including directors, the average number of employees

(at their full time equivalent) during the year was as follows:

Management and administration 25 12

Support and development staff 48 29

Average numbers of employees 73 41

The employee benefits expense during the year was as follows:

Wages and salaries 3,870 2,214

Social security costs 453 265

Other pension costs 86 46

Total employee benefits expense 4,408 2,526

Share based payments (note 20) 546 312

Wages and salaries directly attributable to the development of R&D products are capitalised in intangible assets (note 9).

2021 2020

7. DIRECTORS EMOLUMENTS £000 £000

Aggregate remuneration in respect of qualifying services 221 258

Aggregate amounts of contributions to pension

4 5

schemes in respect of qualifying services

Gain on exercise of options 43 -

Total Directors’ emoluments 268 263

Highest paid director - aggregate remuneration (excluding share based payments) 104 96 FINANCE

There are two directors (2020: two) who are accruing retirement benefits in respect of qualifying services.

2021 2020

8. TAXATION EXPENSE £000 £000

Current tax

UK tax (32) (16)

Foreign tax on overseas companies 28 25

Total current tax (4) 9

Origination and reversal of temporary differences (345) 94

Total deferred tax (345) 94

Tax on profit on ordinary activities (349) 103

The differences between the total tax credit above and the amount calculated by applying the standard rate of UK

corporation tax to the profit before tax, together with the impact of the effective tax rate, are as follows:

77