Page 169 - FBL AR 2019-20

P. 169

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

Notes to the Standalone financial statements for the year ended March 31, 2020

58 Share-based payments (contd.)

Options granted under ESOP 2019 shall vest not before 1 (one) year and not later than maximum Vesting Period of 5 (five) years from the date

of grant of such Options. Subject to the minimum vesting period of one year, the Nomination and Remuneration Committee of the Board at

its discretion approve for acceleration of Vesting of any or all unvested Options of the Option Grantee.

The above number of options, fair value at grant dates and exercise price are adjusted in accordance with the Share exchange ratio (0.398:1)

as per the scheme of amalgamation.

**The number of options are after giving effect of the amalgamation and bonus shares issued during the year.

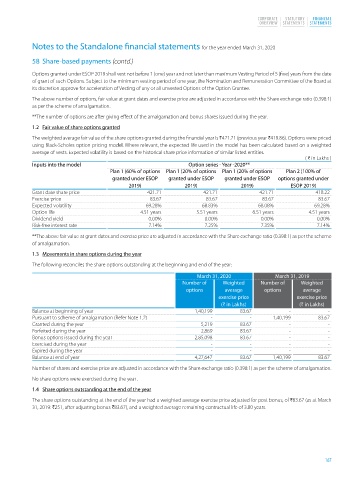

1.2 Fair value of share options granted

The weighted average fair value of the share options granted during the financial year is H421.71 (previous year H419.86). Options were priced

using Black-Scholes option pricing model. Where relevant, the expected life used in the model has been calculated based on a weighted

average of vests. Expected volatility is based on the historical share price information of similar listed entities.

( H in Lakhs )

Inputs into the model Option series - Year -2020**

Plan 1 (60% of options Plan 1 (20% of options Plan 1 (20% of options Plan 2 (100% of

granted under ESOP granted under ESOP granted under ESOP options granted under

2019) 2019) 2019) ESOP 2019)

Grant date share price 421.71 421.71 421.71 418.22

Exercise price 83.67 83.67 83.67 83.67

Expected volatility 69.28% 68.83% 68.08% 69.28%

Option life 4.51 years 5.51 years 6.51 years 4.51 years

Dividend yield 0.00% 0.00% 0.00% 0.00%

Risk-free interest rate 7.14% 7.25% 7.35% 7.14%

**The above fair value at grant dates and exercise price are adjusted in accordance with the Share exchange ratio (0.398:1) as per the scheme

of amalgamation.

1.3 Movements in share options during the year

The following reconciles the share options outstanding at the beginning and end of the year:

March 31, 2020 March 31, 2019

Number of Weighted Number of Weighted

options average options average

exercise price exercise price

(H in Lakhs) (H in Lakhs)

Balance at beginning of year 1,40,199 83.67 - -

Pursuant to scheme of amalgamation (Refer Note 1.2) - - 1,40,199 83.67

Granted during the year 5,219 83.67 - -

Forfeited during the year 2,869 83.67 - -

Bonus options issued during the year 2,85,098 83.67 - -

Exercised during the year - - - -

Expired during the year - - - -

Balance at end of year 4,27,647 83.67 1,40,199 83.67

Number of shares and exercise price are adjusted in accordance with the Share exchange ratio (0.398:1) as per the scheme of amalgamation.

No share options were exercised during the year .

1.4 Share options outstanding at the end of the year

The share options outstanding at the end of the year had a weighted average exercise price adjusted for post bonus, of H83.67 (as at March

31, 2019: H251, after adjusting bonus H83.67), and a weighted average remaining contractual life of 3.80 years.

167