Page 4 - LILITED LIABILITY COMPANIES - INTERMEDIATE

P. 4

COMPANY ACCOUNTING SESSION 14

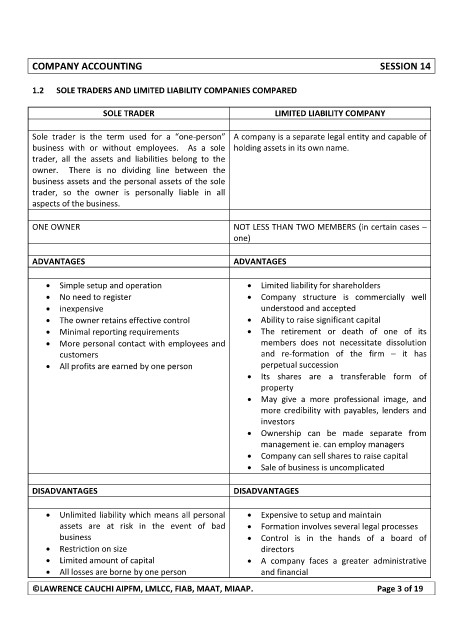

1.2 SOLE TRADERS AND LIMITED LIABILITY COMPANIES COMPARED

SOLE TRADER LIMITED LIABILITY COMPANY

Sole trader is the term used for a “one-person” A company is a separate legal entity and capable of

business with or without employees. As a sole holding assets in its own name.

trader, all the assets and liabilities belong to the

owner. There is no dividing line between the

business assets and the personal assets of the sole

trader, so the owner is personally liable in all

aspects of the business.

ONE OWNER NOT LESS THAN TWO MEMBERS (in certain cases –

one)

ADVANTAGES ADVANTAGES

• Simple setup and operation • Limited liability for shareholders

• No need to register • Company structure is commercially well

• inexpensive understood and accepted

• The owner retains effective control • Ability to raise significant capital

• Minimal reporting requirements • The retirement or death of one of its

• More personal contact with employees and members does not necessitate dissolution

customers and re-formation of the firm – it has

• All profits are earned by one person perpetual succession

• Its shares are a transferable form of

property

• May give a more professional image, and

more credibility with payables, lenders and

investors

• Ownership can be made separate from

management ie. can employ managers

• Company can sell shares to raise capital

• Sale of business is uncomplicated

DISADVANTAGES DISADVANTAGES

• Unlimited liability which means all personal • Expensive to setup and maintain

assets are at risk in the event of bad • Formation involves several legal processes

business • Control is in the hands of a board of

• Restriction on size directors

• Limited amount of capital • A company faces a greater administrative

• All losses are borne by one person and financial

©LAWRENCE CAUCHI AIPFM, LMLCC, FIAB, MAAT, MIAAP. Page 3 of 19