Page 15 - Crewe Alexandra Football Club Company Ltd Accounts 2023-24

P. 15

THE CREWE ALEXANDRA FOOTBALL CLUB COMPANY LIMITED NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE YEAR ENDED 30 JUNE 2024

2 Judgements and key sources of estimation uncertainty

In the application of the company’s accounting policies, the directors are required to make judgements, estimates and assumptions about the carrying amount of assets and liabilities that are not readily apparent from other sources. The estimates and associated assumptions are based on historical experience and other factors that are considered to be relevant. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised where the revision affects only that period, or in the period of the revision and future periods where the revision affects both current and future periods.

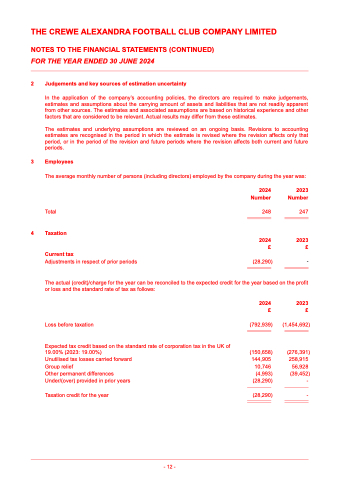

3 Employees

The average monthly number of persons (including directors) employed by the company during the year was:

2024 2023 Number Number

248 247

2024 2023 ££

(28,290) - The actual (credit)/charge for the year can be reconciled to the expected credit for the year based on the profit

Total

4 Taxation Current tax

Adjustments in respect of prior periods

or loss and the standard rate of tax as follows:

Loss before taxation

Expected tax credit based on the standard rate of corporation tax in the UK of 19.00% (2023: 19.00%)

Unutilised tax losses carried forward

Group relief

Other permanent differences Under/(over) provided in prior years

Taxation credit for the year

2024 2023 ££

(792,939)

(150,658) 144,905 10,746

(4,993) (28,290)

(28,290)

(1,454,692)

(276,391) 258,915 56,928

(39,452) -

-

- 12 -