Page 17 - Crewe Alexandra Football Club Company Ltd Accounts 2023-24

P. 17

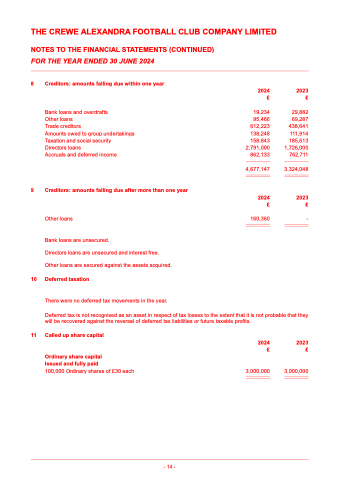

THE CREWE ALEXANDRA FOOTBALL CLUB COMPANY LIMITED NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE YEAR ENDED 30 JUNE 2024

8 Creditors: amounts falling due within one year

Bank loans and overdrafts

Other loans

Trade creditors

Amounts owed to group undertakings Taxation and social security

Directors loans

Accruals and deferred income

9 Creditors: amounts falling due after more than one year

Other loans

Bank loans are unsecured.

Directors loans are unsecured and interest free. Other loans are secured against the assets acquired.

10 Deferred taxation

There were no deferred tax movements in the year.

2024 2023 ££

19,234

95,466 612,223 138,248 158,843

2,791,000 862,133

4,677,147

2024 ££

160,360 -

29,882

69,287 438,641 111,914 185,613 1,726,000 762,711

3,324,048

2023

Deferred tax is not recognised as an asset in respect of tax losses to the extent that it is not probable that they will be recovered against the reversal of deferred tax liabilities or future taxable profits.

11 Called up share capital

Ordinary share capital

Issued and fully paid

100,000 Ordinary shares of £30 each

2024 2023 ££

3,000,000 3,000,000

- 14 -