Page 11 - Your Guide to RM Booklet

P. 11

HECM Updates: Real Borrower, Real Story

A Better Solution for Borrowers

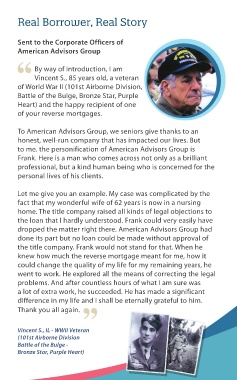

Sent to the Corporate Officers of

American Advisors Group

For 30 years, older adults have been able to take advantage of

HECM loans as way of improving their finances. Through the By way of introduction, I am

years, government-insured loans have been updated to become Vincent S., 85 years old, a veteran

better, safer and more flexible. of World War II (101st Airborne Division,

Battle of the Bulge, Bronze Star, Purple

Below are the most recent updates: Heart) and the happy recipient of one

of your reverse mortgages.

FINANCIAL ASSESSMENT: A financial assessment is

required by HUD to ensure that a reverse mortgage can To American Advisors Group, we seniors give thanks to an

be a sustainable, long-term solution for borrowers. honest, well-run company that has impacted our lives. But

to me. the personification of American Advisors Group is

Frank. Here is a man who comes across not only as a brilliant

NON-BORROWING SPOUSE: Loan amounts are now professional, but a kind human being who is concerned for the

available to borrowers with a non-borrowing spouse personal lives of his clients.

under the age of 62. Rules allow the surviving eligible

spouses of borrowers who pass away to remain in the Let me give you an example. My case was complicated by the

home under the same loan terms. fact that my wonderful wife of 62 years is now in a nursing

home. The title company raised all kinds of legal objections to

the loan that I hardly understood. Frank could very easily have

MORE AFFORDABLE OVER TIME: Upfront mortgage dropped the matter right there. American Advisors Group had

insurance premiums (MIPs) have been standardized done its part but no loan could be made without approval of

by the Federal Housing Administration to bolster the the title company. Frank would not stand for that. When he

reverse mortgage loan product. The (FHA) has set the knew how much the reverse mortgage meant for me, how it

upfront MIP to 2% of the appraised value of the home. could change the quality of my life for my remaining years, he

A reduction in annual MIPs has made the loan more went to work. He explored all the means of correcting the legal

affordable. Borrowers will now be charged an annual problems. And after countless hours of what I am sure was

MIP of 0.5% of the outstanding mortgage balance a lot of extra work, he succeeded. He has made a significant

difference in my life and I shall be eternally grateful to him.

- reduced from 1.25%. This reduction can add up to Thank you all again.

thousands of dollars saved over the life of the loan.

Vincent S., IL - WWII Veteran

(101st Airborne Division

Battle of the Bulge -

Bronze Star, Purple Heart)

Your Guide to a Better Retirement 6