Page 3 - WSAAG053_HECM for Purchase Booklet

P. 3

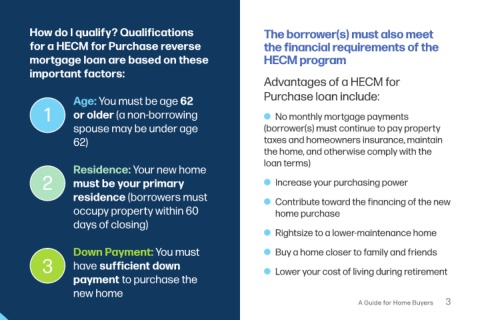

How do I qualify? Qualifications The borrower(s) must also meet

for a HECM for Purchase reverse the financial requirements of the

mortgage loan are based on these HECM program

important factors:

Advantages of a HECM for

Age: You must be age 62 Purchase loan include:

1 or older (a non-borrowing n No monthly mortgage payments

spouse may be under age (borrower(s) must continue to pay property

62) taxes and homeowners insurance, maintain

the home, and otherwise comply with the

loan terms)

Residence: Your new home

2 must be your primary n Increase your purchasing power

residence (borrowers must n Contribute toward the financing of the new

occupy property within 60 home purchase

days of closing)

n Rightsize to a lower-maintenance home

Down Payment: You must n Buy a home closer to family and friends

3 have sufficient down n Lower your cost of living during retirement

payment to purchase the

new home

A Guide for Home Buyers 3