Page 3 - B2BAAG14_Builders Presentation

P. 3

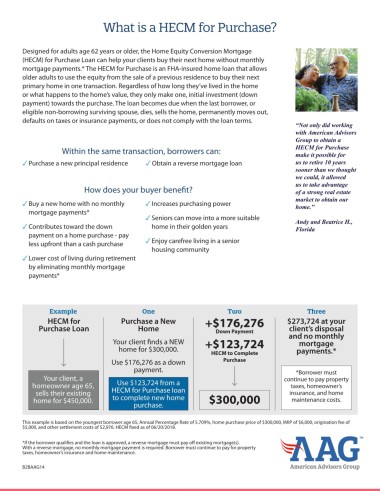

What is a HECM for Purchase?

Designed for adults age 62 years or older, the Home Equity Conversion Mortgage

(HECM) for Purchase Loan can help your clients buy their next home without monthly

mortgage payments.* The HECM for Purchase is an FHA-insured home loan that allows

older adults to use the equity from the sale of a previous residence to buy their next

primary home in one transaction. Regardless of how long they’ve lived in the home

or what happens to the home’s value, they only make one, initial investment (down

payment) towards the purchase. The loan becomes due when the last borrower, or

eligible non-borrowing surviving spouse, dies, sells the home, permanently moves out,

defaults on taxes or insurance payments, or does not comply with the loan terms.

“Not only did working

with American Advisors

Group to obtain a

Within the same transaction, borrowers can: HECM for Purchase

make it possible for

3Purchase a new principal residence 3Obtain a reverse mortgage loan us to retire 10 years

sooner than we thought

we could, it allowed

us to take advantage

How does your buyer benefit? of a strong real estate

market to obtain our

3 Buy a new home with no monthly 3 Increases purchasing power home.”

mortgage payments*

3 Seniors can move into a more suitable Andy and Beatrice H.,

3 Contributes toward the down home in their golden years Florida

payment on a home purchase - pay

less upfront than a cash purchase 3 Enjoy carefree living in a senior

housing community

3 Lower cost of living during retirement

by eliminating monthly mortgage

payments*

Example One Two Three

HECM for Purchase a New +$176,276 $273,724 at your

Purchase Loan Home Down Payment client’s disposal

Your client finds a NEW +$123,724 and no monthly

mortgage

home for $300,000. payments.*

HECM to Complete

Use $176,276 as a down Purchase

payment. *Borrower must

Your client, a continue to pay property

homeowner age 65, Use $123,724 from a taxes, homeowner’s

sells their existing HECM for Purchase loan insurance, and home

home for $450,000. to complete new home $300,000 maintenance costs.

purchase.

This example is based on the youngest borrower age 65, Annual Percentage Rate of 5.709%, home purchase price of $300,000, IMIP of $6,000, origination fee of

$5,000, and other settlement costs of $2,976. HECM fixed as of 06/20/2018.

*If the borrower qualifies and the loan is approved, a reverse mortgage must pay off existing mortgage(s).

With a reverse mortgage, no monthly mortgage payment is required. Borrower must continue to pay for property

taxes, homeowner’s insurance and home maintenance.

B2BAAG14