Page 9 - Your Guide to Retirement Booklet

P. 9

Five Strategic Ways to Use a

Reverse Mortgage Loan

1. HECM Growing Line of Credit 2. Protection from Investment Downturns

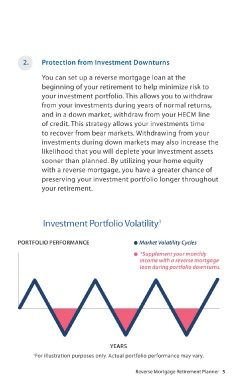

Only available to homeowners 62 and over, a HECM You can set up a reverse mortgage loan at the

growing line of credit is similar to a home equity line beginning of your retirement to help minimize risk to

of credit (HELOC), only much better. With it, you can your investment portfolio. This allows you to withdraw

establish a line of credit using a reverse mortgage loan, from your investments during years of normal returns,

and you can let that line of credit grow at an interest and in a down market, withdraw from your HECM line

rate that is equal to current loan rates. And unlike of credit. This strategy allows your investments time

a traditional HELOC, this loan does not have a pre- to recover from bear markets. Withdrawing from your

determined repayment period—it can be available for a investments during down markets may also increase the

duration determined by you. A HECM line of credit also likelihood that you will deplete your investment assets

includes a compounding feature, which means your sooner than planned. By utilizing your home equity

available credit increases each period on the prior with a reverse mortgage, you have a greater chance of

period’s available credit balance. At any time, the line preserving your investment portfolio longer throughout

of credit can be accessed for incidental cash or even your retirement.

converted to monthly term or tenure payments.

HECM Reverse Mortgage

Growing Line of Credit Investment Portfolio Volatility 1

PORTFOLIO PERFORMANCE Market Volatility Cycles

*Supplement your monthly

income with a reverse mortgage

loan during portfolio downturns.

LINE OF CREDIT AMOUNT

1 2 3 4 5 6 7 8 9 10

YEARS

YEARS 1 For illustration purposes only. Actual portfolio performance may vary.

Reverse Mortgage Retirement Planner 5