Page 1 - AAG030_Best Purchasing Plan Flyer

P. 1

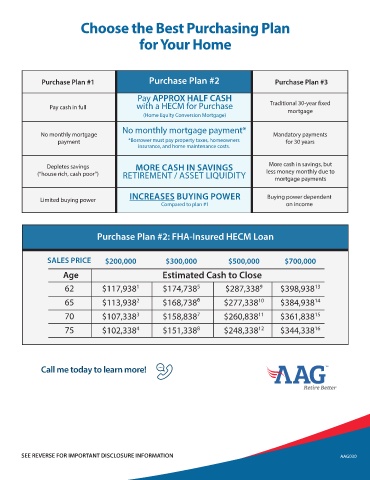

Choose the Best Purchasing Plan

for Your Home

Purchase Plan #1 Purchase Plan #2 Purchase Plan #3

Pay APPROX HALF CASH

Pay cash in full with a HECM for Purchase Traditional 30-year fixed

(Home Equity Conversion Mortgage) mortgage

No monthly mortgage payment*

No monthly mortgage Mandatory payments

payment *Borrower must pay property taxes, homeowners for 30 years

insurance, and home maintenance costs.

Depletes savings MORE CASH IN SAVINGS More cash in savings, but

(“house rich, cash poor”) RETIREMENT / ASSET LIQUIDITY less money monthly due to

mortgage payments

INCREASES BUYING POWER Buying power dependent

Limited buying power

Compared to plan #1 on income

Purchase Plan #2: FHA-Insured HECM Loan

SALES PRICE $200,000 $300,000 $500,000 $700,000

Age Estimated Cash to Close

1

62 $117,938 $174,738 5 $287,338 9 $398,938 13

65 $113,938 2 $168,738⁶ $277,338 10 $384,938 14

70 $107,338 3 $158,838 7 $260,838 11 $361,838 15

75 $102,338 4 $151,338 8 $248,338 12 $344,338 16

Call me today to learn more!

SEE REVERSE FOR IMPORTANT DISCLOSURE INFORMATION AAG030